Are You Really Targeting Your Customers Right?

Today, marketing is all about knowing your customers well and reaching them with the right message. But many businesses struggle with this.

How well do you know your customers?

Can you easily find out who buys often, who spends the most, and who hasn’t bought in a while?

According to Salesforce, 79% of consumers expect connected and personalized experiences, but only 27% of marketers say they deliver this consistently.

Good targeting starts with segmentation—grouping customers based on behavior and value. One of the easiest and most effective ways to do this is with the RFM segmentation model.

What is RFM Segmentation?

RFM stands for:

- Recency — How recently did a customer make a purchase?

- Frequency — How often does the customer buy?

- Monetary — How much money does the customer spend?

By evaluating these three factors, you can classify your customers into groups based on their purchasing behavior and value to your business.

Why These Three?

- Recency: Customers who purchased recently are more likely to buy again.

- Frequency: Customers who buy frequently are more engaged and loyal.

- Monetary: Customers who spend more bring higher revenue and profit.

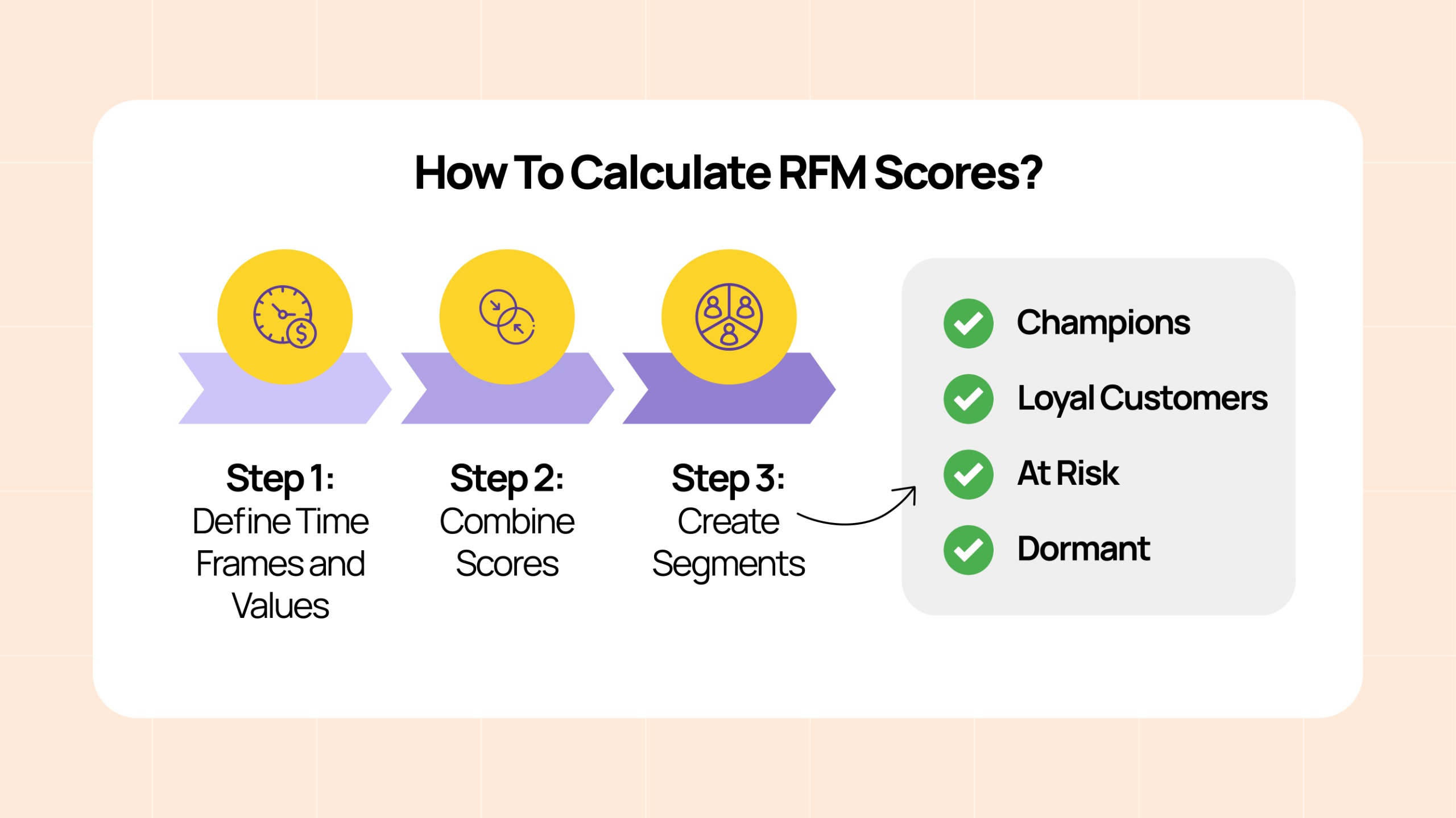

How To Calculate RFM Scores?

RFM scoring typically involves assigning values to each customer for Recency, Frequency, and Monetary metrics — usually on a scale of 1 to 5, with 5 being the best.

Step 1: Define Time Frames and Values

- For Recency, divide customers based on how long ago they made their last purchase. The most recent buyers get a score of 5; the least recent, a 1.

- For Frequency, rank customers by how many purchases they made in a period. Frequent buyers score higher.

- For Monetary, rank customers by their total spend during a time frame. The highest spenders score 5.

Step 2: Combine Scores

Each customer receives an R, F, and M score. For example:

- (5,5,5) = Your best customers — recent, frequent, high spenders

- (1,1,1) = Customers who haven’t purchased in a long time, buy infrequently, and spend little

Step 3: Create Segments

You can combine scores into segments, such as:

- Champions: High in all three metrics (5,5,5)

- Loyal Customers: Moderate Recency, High Frequency, and Monetary

- At Risk: High Monetary and Frequency but low Recency

- Dormant: Low in all metrics

Implications for CRM

Understanding RFM scores isn’t just about numbers — it’s about translating those scores into meaningful insights that guide your marketing efforts.

By applying the RFM framework within your CRM, you gain a clearer view of who your best customers are, who might be slipping away, and where your marketing dollars can have the greatest impact. This insight empowers you to act proactively where you nurture loyalty, reactivate valuable customers, and minimize wasted spend.

Let’s explore how these RFM insights translate into customer behavior signals, what data your CRM should track to make them actionable, and the risks businesses face if they ignore these patterns.

Customer Behavior Insights

- High RFM scores identify loyal, high-value customers likely to purchase again soon.

- Low Recency but high Frequency and Monetary scores indicate customers at risk of churn — prime candidates for reactivation.

- Low-frequency and Monetary scores point to occasional or low-value customers.

What to Track in CRM

- Purchase dates, counts, and transaction values.

- Segment movement over time to detect churn or growth trends.

- Trigger events for re-engagement or upselling based on RFM changes.

Risks if Ignored

Ignoring RFM patterns may lead to inefficient marketing spend, missed retention opportunities, and higher churn rates. Generic campaigns waste resources and alienate customers expecting relevance.

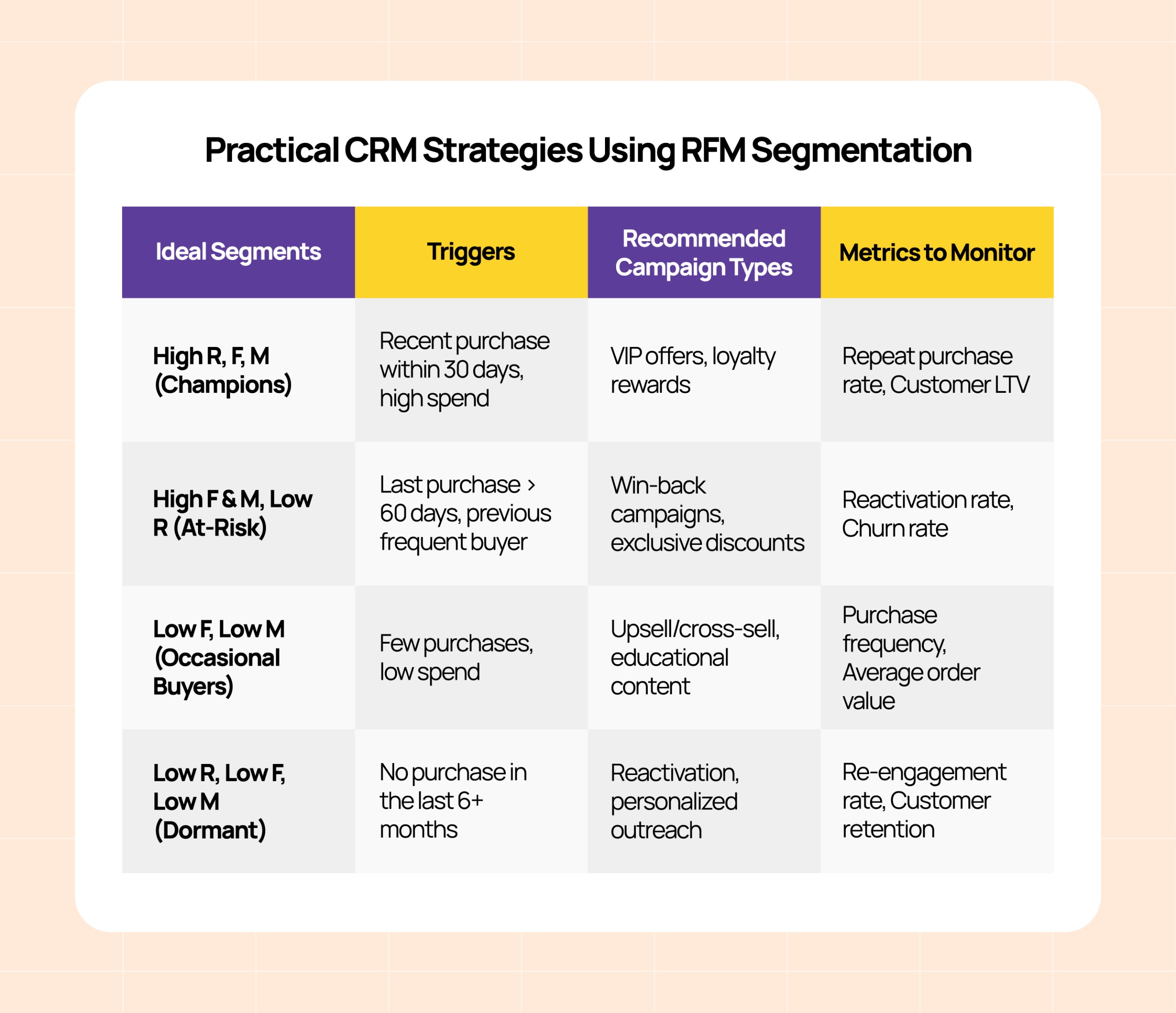

Practical CRM Strategies Using RFM Segmentation

To make the most of RFM insights, it’s essential to translate scores into targeted actions within your CRM system. This means defining clear customer segments, setting up triggers based on behavior, and deploying tailored campaigns that resonate with each group.

The following playbook outlines common segments, the conditions that identify them, recommended campaign types, and key metrics to track success, giving you a practical roadmap to apply RFM effectively and drive better marketing outcomes.

Common Pitfalls & How To Avoid Them?

While the RFM segmentation model is powerful and widely used, it is not without challenges. Understanding these pitfalls can help you avoid mistakes that reduce the effectiveness of your segmentation and campaigns.

1. Data Quality Issues

Your RFM analysis is only as good as the data you feed into it. Missing, outdated, or incorrect transaction records can skew Recency, Frequency, and Monetary scores, leading to misguided targeting. For example, if recent purchases aren’t recorded promptly, customers may be misclassified as inactive or at-risk.

How to avoid:

- Regularly audit and cleanse your transaction data.

- Integrate all relevant sales channels into your CRM to capture a complete customer picture.

- Automate data validation processes where possible.

2. Over-Segmentation Complexity

While segmenting customers in finer detail might seem beneficial, too many small segments can overwhelm your marketing resources. This “campaign paralysis” leads to scattered efforts, inconsistent messaging, and diluted impact.

How to avoid:

- Start with broad, meaningful segments based on RFM scores (e.g., Champions, At-Risk, Dormant).

- Gradually refine segments only when you can execute targeted campaigns effectively.

- Prioritize segments that represent the greatest business value or risk.

3. Ignoring the Temporal Nature of RFM

Customer behavior evolves, making it critical to update RFM scores regularly. Treating RFM as a static snapshot can lead to outdated segments that no longer reflect current realities. For instance, a previously high-value customer may become dormant, or a low-frequency buyer may increase purchase activity.

How to avoid:

- Schedule regular recalculations of RFM scores (monthly or quarterly).

- Monitor segment movement trends over time to identify emerging opportunities or risks.

- Adjust campaigns dynamically based on the latest segmentation.

Conclusion

The RFM segmentation model remains a foundational tool for marketers seeking to understand and engage their customers better. By focusing on Recency, Frequency, and Monetary value, it provides clear, actionable insights that can transform how you target, personalize, and prioritize marketing efforts.

However, like any tool, its success depends on thoughtful implementation — ensuring your data is accurate, your segments manageable, and your insights continuously refreshed. When applied well, RFM segmentation helps you focus on the right customers, deliver relevant experiences, and ultimately grow your business more efficiently.

Whether you’re a business owner seeking straightforward targeting, a CRM manager running campaigns, or a data expert optimizing strategy, mastering RFM segmentation equips you with a practical roadmap to maximize customer value and marketing ROI.