The current market scenario suggests that customer acquisition costs are rising and competition is fierce. In these circumstances, Customer Lifetime Value (CLV) is your most valuable metric. Why? Because it tells you how much a customer is worth to your business over the long run, not just with their initial purchase. A study by Bain & Company suggests that increasing customer retention by just 5% can boost profits by 25% to 95%. Yet, despite its power, many businesses overlook CLV in favor of focusing only on new customers.

Here’s a hard truth: Retaining existing customers is far more cost-effective than acquiring new ones. BIA Advisory Services reveals that repeat customers spend 67% more than new ones. And businesses that prioritize customer retention see 6-7 times higher profits from existing clients (Custify). CLV is the bridge between customer satisfaction and sustained growth. By nurturing relationships, you not only increase revenue but also create loyal brand advocates who drive word-of-mouth referrals.

However, understanding CLV isn’t just about keeping your customers happy. It’s about strategically optimizing every touchpoint with personalized experiences, loyalty rewards, and targeted campaigns. The goal is to keep customers engaged for as long as possible, increasing their spend along the way and turning them into lifelong advocates.

In this blog, we’ll uncover how maximizing Customer Lifetime Value directly leads to higher retention, increased revenue, and sustained business growth. From actionable insights on how to calculate and measure CLV to effective CRM strategies that turn data into profit, you’ll discover how to leverage your existing customer base for maximum impact.

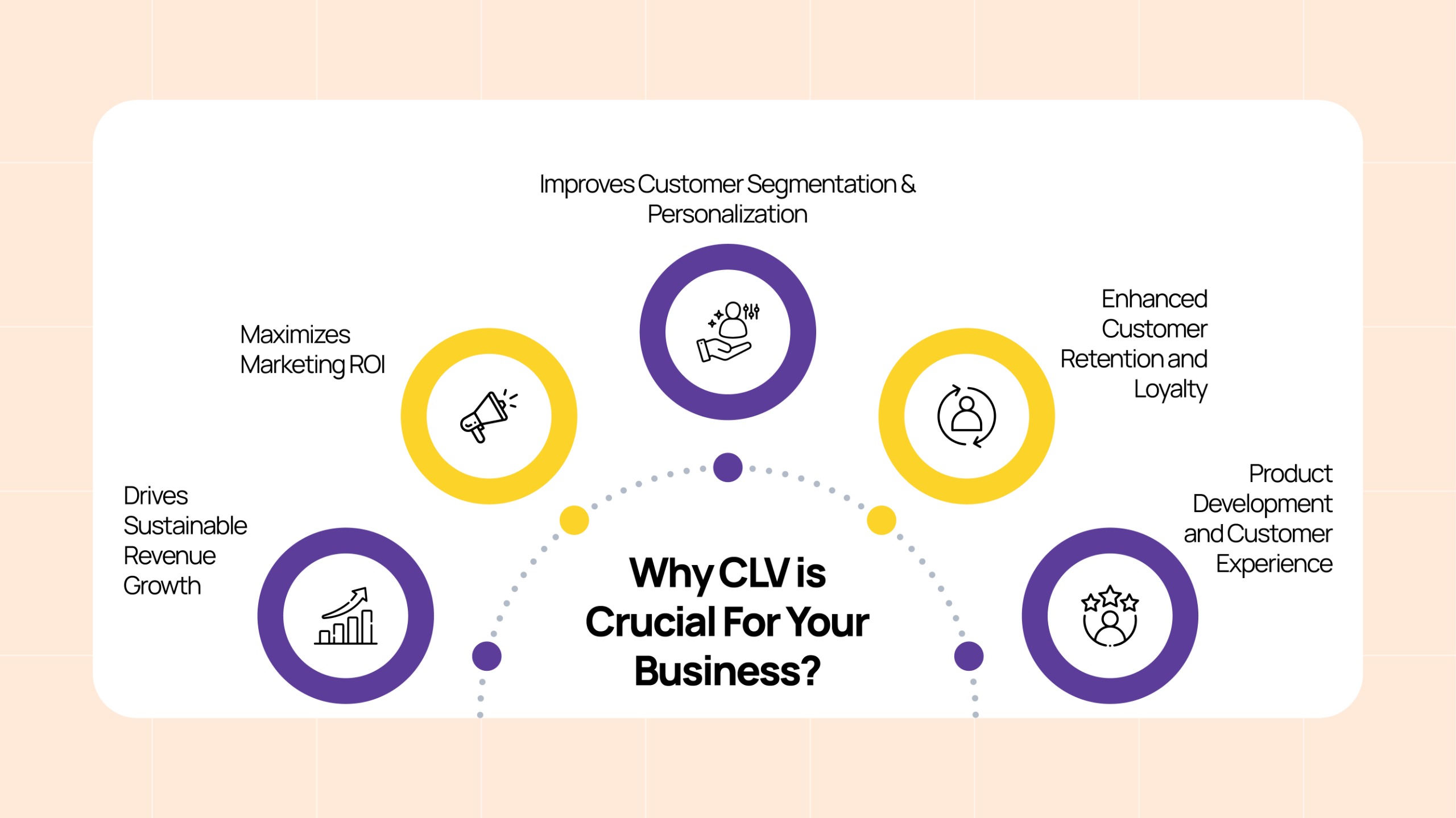

Why CLV is Crucial For Your Business?

Customer Lifetime Value (CLV) is one of the most important metrics for understanding the true value of your customer base. But why exactly is CLV so crucial for your business? The answer lies in its ability to shape your entire strategy, from marketing decisions to customer service efforts, to how you allocate resources for sustainable growth. Let’s break down why CLV should be at the heart of your business strategy.

1. Drives Sustainable Revenue Growth

Focusing on CLV allows you to shift from chasing one-time sales to nurturing long-term relationships with your customers. By increasing retention, you can see exponential growth in revenue over time. This is because loyal customers are more likely to make repeat purchases and spend more per visit, creating a stable revenue stream.

2. Maximizes Marketing ROI

With CLV, you can make smarter marketing investments. Understanding the long-term value of a customer helps you spend efficiently, focusing on retaining high-value clients rather than constantly acquiring new ones. By investing in strategies that increase retention, like loyalty programs, personalized communication, and exceptional customer service, you’ll see a much higher return on your marketing spend.

3. Improves Customer Segmentation & Personalization

Understanding CLV allows businesses to segment customers based on their potential value, not just their transactional history. This insight enables more targeted marketing and personalized experiences. For instance, you can create customized loyalty programs or special offers for high-value customers to further increase their lifetime value.

4. Enhanced Customer Retention and Loyalty

CLV gives you a clear picture of which customers are most likely to stay with your brand long-term. By focusing on these high-value customers and tailoring your engagement strategies, you can build deeper relationships that lead to higher loyalty. Loyal customers are not only more likely to return but also more likely to refer others. Word-of-mouth marketing from satisfied customers is a powerful and cost-effective way to drive new business.

5. Product Development and Customer Experience

CLV is a strategic asset for product development and improving customer experience. By analyzing the behaviors and preferences of high-value customers, you can gain insights into the types of products and services they’re willing to spend more on. This helps inform your product offerings and improves your overall customer experience, ensuring that you cater to the needs of your most profitable segments.

Calculating CLV

CRM’s Role in Maximizing CLV

CRM software enables businesses to effectively track, manage, and analyze customer interactions, making it easier to nurture relationships, personalize experiences, and boost retention. But how exactly does CRM contribute to maximizing CLV? Let’s dive into the key ways CRM systems can help businesses unlock the full potential of their customer base.

- Customer Segmentation for Targeted Marketing

With CRM systems, businesses segment their customers based on various factors like purchasing behavior, frequency, preferences, and demographics. By segmenting customers effectively, businesses can tailor marketing efforts, increase engagement, and improve retention, all of which contribute to maximizing CLV. This holds true with the McKinsey report highlights that businesses that use segmentation and personalization can see 5-8 times higher ROI on marketing spend.

- Personalization of Customer Experience

One of the greatest advantages of a CRM system is its ability to enable personalization. Personalizing customer interactions—whether it’s through emails, offers, or product recommendations—creates a sense of exclusivity and strengthens the relationship between the brand and the customer, ultimately leading to higher CLV.

- Automation of Customer Engagement & Retention Strategies

CRM systems allow businesses to automate engagement and retention efforts by setting up reminders, follow-ups, and loyalty campaigns. Automated processes make it easier to stay connected with customers over time, nurturing their loyalty and keeping them engaged, which directly impacts CLV.

- Enhanced Customer Support and Service

A Zendesk report reveals that 72% of customers are more likely to stay loyal to a company if they receive immediate service. Thus, exceptional customer service plays a critical role in CLV. CRM systems centralize customer data, allowing service teams to access customer histories, preferences, and past interactions. This enables businesses to provide faster, more informed, and more personalized customer service, which increases customer satisfaction and loyalty.

- Predicting Customer Behavior & Analytics

Advanced CRM systems offer predictive analytics capabilities that enable businesses to forecast future customer behavior. By identifying trends, preferences, and behaviors, companies can proactively adjust their strategies to enhance CLV by preventing churn and promoting repeat purchases.

Netflix uses predictive analytics to analyze customers’ viewing habits, recommending content they’re likely to watch next. This personalized content keeps customers engaged longer, reducing churn and increasing subscription renewals—ultimately boosting CLV.

- Strengthening Loyalty Programs

According to a survey, when a company achieves 7% increase in brand loyalty, the CLV of each customer can rise by 85%. This highlights that loyalty programs powered by CRM systems are highly effective at increasing CLV. By tracking customers’ purchase history, CRM can help design loyalty programs that reward customers for both frequency and monetary spend, encouraging them to engage more with your brand and increase their lifetime value.

- Increased Up-Selling & Cross-Selling Opportunities

Salesforce reports that businesses using CRM to automate upselling and cross-selling see up to a 29% increase in sales. CRM systems allow businesses to identify opportunities for upselling and cross-selling based on customer purchase data. By understanding a customer’s needs, preferences, and behavior, businesses can suggest complementary products or upgrades, which increases the average order value and CLV.

The Role of Promotions and Loyalty Programs in Customer Lifetime Value

Promotions and loyalty programs are two of the most effective tools or maximizing Customer Lifetime Value (CLV). While customer acquisition is essential for growth, it’s retention—fostering long-term relationships with existing customers—that truly drives profitability. Loyalty programs and strategic promotions not only increase customer retention but also encourage higher spending and more frequent purchases, directly boosting CLV.

Here’s a breakdown of how these tools play a pivotal role in increasing the lifetime value of your customers:

- Building Long-Term Relationship: By offering customers rewards such as discounts, exclusive access, or special perks, businesses create emotional investment in the brand, which fosters brand loyalty.

- Encouraging Repeat Purchases: Promotions incentivize customers to make additional purchases, helping businesses increase customer frequency and average order value (AOV). Well-timed promotions—such as seasonal discounts, bundle offers, and special deals for loyalty members—drive urgency and excitement, encouraging customers to return for more.

- Increasing Customer Spend Through Tiered Loyalty Programs: Tiered loyalty programs add an additional layer of incentive for customers to engage more deeply with your brand. By offering higher rewards or exclusive benefits at each tier, businesses can encourage customers to spend more to unlock bigger rewards, which increases CLV.

- Boosting CLV with Personalized Promotions: Personalized promotions—such as birthday discounts, anniversary offers, or special offers based on purchase history—show customers that your brand values them personally, which strengthens their emotional connection to your business and increases CLV.

- Reducing Customer Churn: Offering exclusive rewards and early access to promotions for long-term customers makes them feel valued and appreciated, increasing the likelihood that they’ll continue to engage with your brand over time.

Challenges in Measuring CLV and Using CRM Effectively

1. Data Quality Issues

One of the primary challenges businesses face when using CRM systems to measure CLV is data quality. Poor data integrity, whether it’s missing, inaccurate, or outdated information can lead to flawed CLV calculations and misguided business decisions.

- Solution:

- Regularly clean and update CRM data.

- Implement automated data validation rules to ensure that only accurate data enters the CRM system.

- Invest in data management tools to enhance data accuracy across touchpoints.

2. Variable Customer Behavior

Customer behavior is often unpredictable, making it difficult to accurately forecast CLV. Shifts in buying patterns, seasonal changes, and external factors (like economic downturns) can all influence a customer’s lifetime value.

- Solution:

- Use predictive analytics powered by CRM to track changes in customer behavior over time.

- Segment customers by behavioral patterns and apply more dynamic models that account for these shifts, ensuring more accurate CLV projections.

3. Integration Complexities Between CRM Systems and Other Tools

Integrating CRM systems with other business tools, such as marketing automation, sales platforms, or ERP systems, can be a complex process. Incompatibility or siloed data can prevent businesses from gaining a unified view of their customers, hindering efforts to improve CLV.

- Solution:

- Ensure your CRM platform is compatible with other tools in your tech stack.

- Consider adopting a centralized platform that integrates seamlessly with other software to streamline data flow and enhance CRM functionality.

Conclusion

Customer Lifetime Value (CLV) is a powerful indicator of your business’s long-term success. By leveraging CRM systems, businesses can personalize customer interactions, segment users based on their CLV, and implement strategies that retain high-value customers.

Start maximizing your CLV with the right CRM tools today!