Have you ever tried to figure out what makes a customer loyal? Is it their frequency of visits or the size of their spend that determines their loyalty? Well, the truth is, it’s a little bit of both—and finding the right balance can make or break your marketing strategy.

Think about it: Loyalty is the secret for repeat business, but what’s more important—getting customers to come back often (frequency) or making sure they splurge big each time (monetary)? According to Bain & Company, increasing customer retention by just 5% can boost profits by a staggering 25% to 95%. But how do you keep customers coming back, without constantly slashing prices or bombarding them with discounts?

That’s where the Frequency vs. Monetary Trade-Off comes in—a psychological balance that requires careful calculation. Here’s the thing: your customers’ loyalty is dynamic between how often they engage and how much they spend. And when you get this balance right, the rewards are huge.

In this blog, we’ll dive into the psychology behind the frequency vs. monetary trade-off, how you can leverage CRM strategies to optimize both, and real-world examples of brands that are making this work for them.

What is Frequency Vs. Monetary Tradeoff?

The Frequency vs. Monetary Trade-Off is a concept in customer loyalty that centers around the balance between how often a customer engages with your brand and how much they spend during each interaction.

Why does it matter?

Customer retention is one of the most effective ways to grow your business. But understanding how to retain customers requires knowing how to balance these two key elements of loyalty: frequency and monetary value.

- Frequency: This refers to how often a customer interacts with your brand. It could be how often they visit your store, how often they open your emails, or how often they make purchases.

- Monetary: This refers to how much the customer spends each time they interact with your brand. A high-spending customer might come around less often but still be valuable.

For example, you might have two types of customers:

- Frequent shoppers who buy low-ticket items often.

- Infrequent shoppers who make high-ticket purchases but don’t visit as often.

As a business, you need to determine the right balance between these two behaviors to optimize loyalty, revenue, and customer satisfaction. Getting this balance right can help you focus your marketing and CRM strategies to improve customer retention and increase lifetime value (CLV).

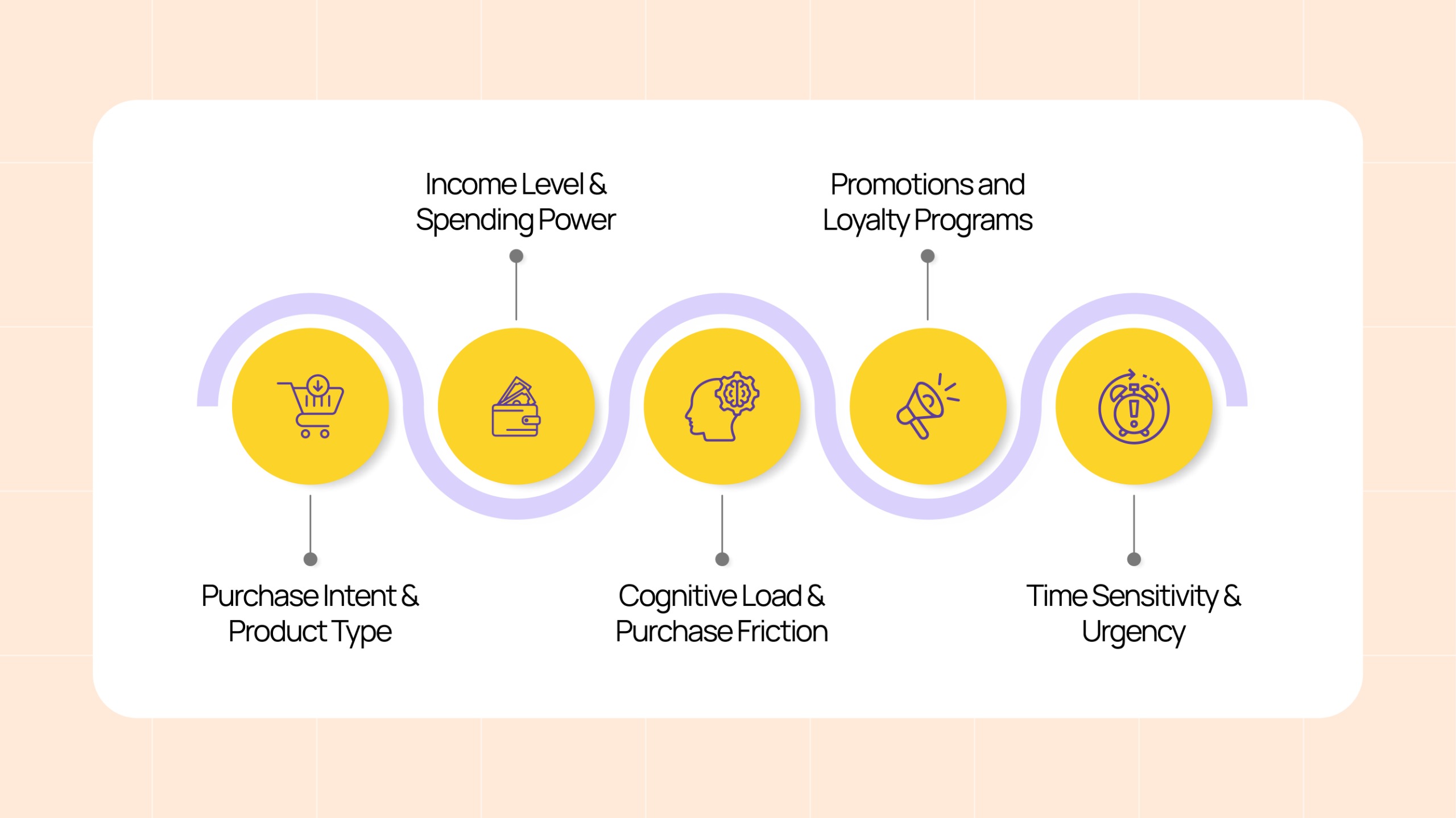

Why Do Customers Choose Frequency or Monetary Spends?

When it comes to making purchasing decisions, customers don’t always follow a clear pattern. Some prefer to shop frequently but spend less per visit, while others make infrequent but large purchases. Understanding why customers fall into these two categories is crucial for optimizing your marketing and CRM strategies.

The Frequency vs. Monetary Trade-Off helps businesses understand this consumer behavior and make smarter decisions on how to engage and retain their customers.

- Purchase Intent & Product Type

According to PwC, 80% of American Consumers believe that speed, convenience, and extraordinary services are important for them to be loyal to a brand. Thus, accordingly-

- FMCG or low-ticket items (e.g., coffee, groceries, beauty products): Customers are more likely to purchase frequently with smaller spends.

- High-involvement products (e.g., electronics, luxury fashion, home appliances): These are typically less frequent but higher-value purchases.

- Income Level & Spending Power

According to a Hubspot report, 46% of Gen Z are more likely to make multiple low-ticket impulse purchases than save up for one big-ticket item. With this category-

- Customers with higher disposable income may be inclined toward larger but less frequent spends, seeking premium experiences.

- Price-sensitive customers tend to opt for frequent, low-cost purchases due to budgeting patterns or cash-flow constraints.

- Cognitive Load & Purchase Friction

- Repeated low-value transactions are often habitual, requiring less decision-making effort.

- High-value purchases involve more research, comparisons, and deliberation, making them more intentional and less frequent.

This is where behavioral economics kicks in. The Endowment Effect suggests that once a customer starts buying often, they tend to continue, because they feel emotionally invested in the brand.

- Promotions and Loyalty Programs

The structure of your promotions and rewards heavily influences behavior:

- If your CRM or loyalty program offers rewards for every purchase, you’ll drive up frequency.

- If you give milestone rewards (e.g., spend ₹10,000, get ₹1,000 off), you’ll incentivize higher spending.

- Time Sensitivity & Urgency

Certain segments, like busy professionals or parents, prefer less frequent, bulk purchases to save time. Others may shop frequently for emotional satisfaction, trend-following (especially in fashion), or lifestyle reasons.

Impact on Your CRM Strategy

Understanding whether your customers are frequent spenders or high-value buyers isn’t just a data point—it’s a strategic goldmine. This trade-off directly shapes how you engage, reward, and retain them.

Here’s how it impacts your CRM:

- Smarter Segmentation

Use RFM (Recency, Frequency, Monetary) analysis to group users and build campaigns accordingly. By identifying customers based on frequency vs. monetary spend, you can create micro-segments that behave differently and need different messaging.

- Frequent Shoppers: Want instant gratification, small wins, and regular engagement.

- Big Spenders: Prefer exclusivity, milestone rewards, and premium experiences.

- Impactful Loyalty Programs

A one-size-fits-all rewards system won’t work. Your loyalty program must incentivize each behavior appropriately.

- Reward frequency with quick cashback, points-per-purchase, or stamp cards.

- Reward high-spenders with tier-based benefits, early access, and high-value redemption options.

- Higher Conversion with Targeted Marketing

CRM automations should reflect how your customers buy.

- Send timely reminders to frequent buyers—”Time to refill!”

- Send upsell/cross-sell nudges to high-value buyers—”Add this to your premium combo.”

- Predictive Campaigns

When you understand which group contributes more to your revenue, your CRM can help you predict future behavior and allocate resources wisely.

- Do you push more nudges to increase frequency?

- Or do you deepen engagement with your top spenders?

H&M’s Frequency Vs. Monetary Tradeoff

H&M’s loyalty program strategically combines frequent, low-spender rewards with high-ticket offers for infrequent shoppers.

1. Frequent, Low-Spender Customers

- Behavior: These customers often buy seasonal items or basics (e.g., t-shirts, socks) at affordable prices.

- Strategy: H&M offers points through its H&M Club loyalty program, giving customers access to discounts, free shipping, and birthday rewards for frequent purchases.

- Goal: Drive high-frequency purchases with incentives such as exclusive discounts or early access to sales.

2. Infrequent, High-Spender Customers

- Behavior: Shoppers who make occasional purchases but spend a larger amount per visit on new collections or high-quality items.

- Strategy: H&M provides VIP rewards like early access to premium collections, special discounts for major purchases, or bonus points on higher spend.

- Goal: Incentivize bigger purchases by offering special rewards for high spenders, making them feel valued even if they don’t shop as often.

Outcome:

H&M boosts retention and CLV by effectively engaging both frequent, low-ticket shoppers and infrequent, high-ticket shoppers with tailored rewards and experiences.

Conclusion

Understanding the frequency vs. monetary trade-off isn’t just about choosing one over the other; it’s about finding a balance that works for your business and maximizes customer lifetime value. By strategically leveraging CRM data, personalizing customer experiences, and aligning rewards with customer behaviors, you can drive engagement, increase retention, and ultimately increase your revenue.