When India ushered in GST in 2017, it promised to simplify indirect taxation. But over time, multiple slabs, exemptions, and ambiguities crept back in. This year, in September, a bold reset has arrived: GST 2.0.

For retail business owners, marketing heads, and CRM leaders, the question is no longer if this matters, it’s how much and how fast you should respond.

In this article, we break down the new GST slabs (as per ClearTax’s updated rates), analyze real-world consumer behavior and tax trends, and reveal how this reform is reshaping the retail landscape, from pricing and procurement to marketing and loyalty strategy.

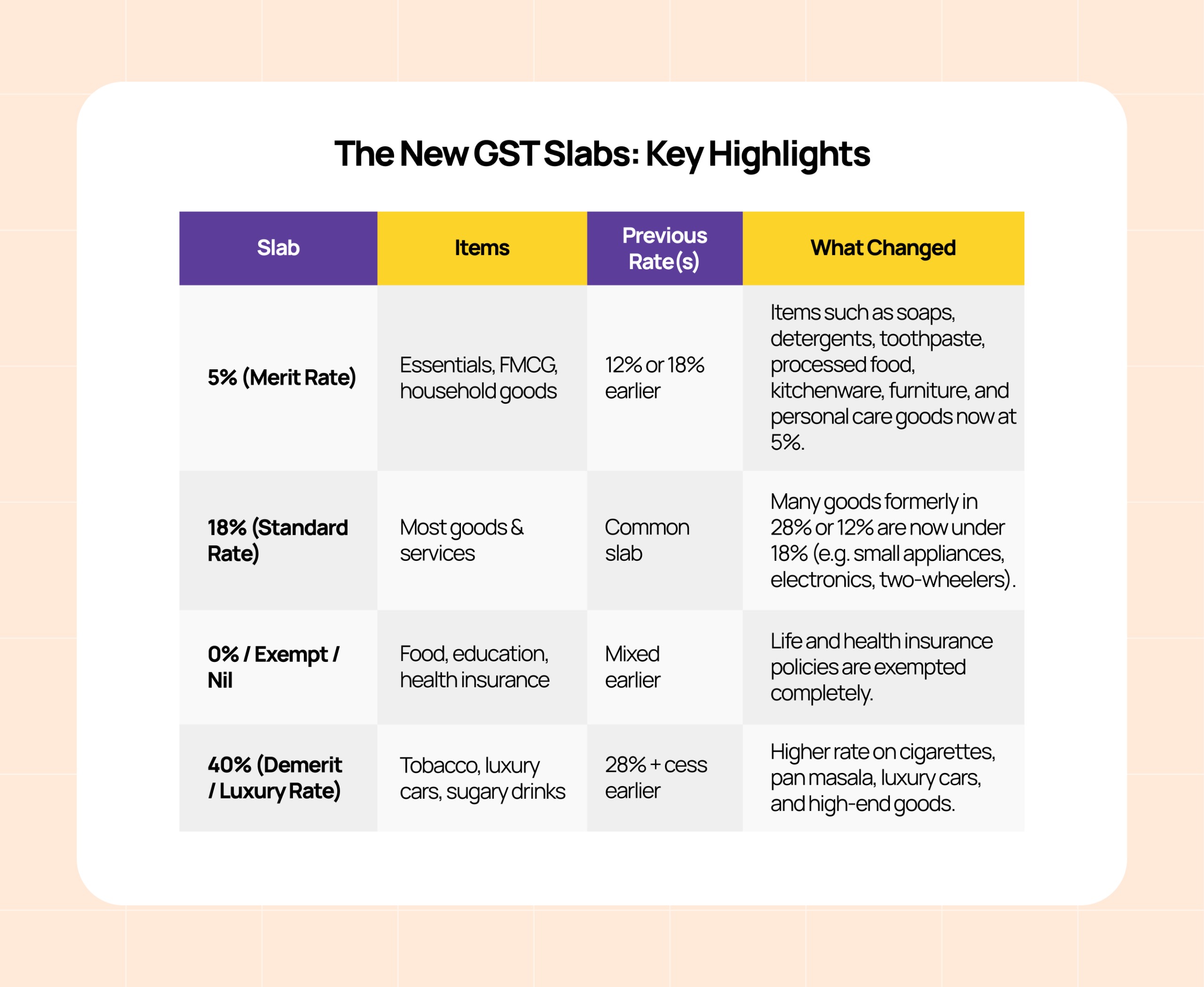

The New GST Slabs: Simplified, But With a Sting

The 56th GST Council Meeting on 3 September 2025 introduced a sweeping reform effective 22 September 2025, aimed at rationalizing tax rates, reducing distortions, and driving consumer sentiment ahead of the festive season.

Key Highlights

The broader message is clear: mass-market items are now largely at 5% or 18%, simplifying classification and reducing overall tax burden.

However, categories like tobacco, luxury goods, and certain beverages face steeper taxes under the 40% bracket. Gold, silver, and precious stones remain under special classifications (0.25% or 3%).

Real-World Momentum and Macro Indicators

Policy shifts matter when they drive behavior. Here’s what the early data shows:

- GST Collections Remain Strong: In May 2025, collections rose 16.4% year-on-year, with July figures crossing ₹1.95 lakh crore, up 7.5% YoY.

- Retail Surge During Navratri: Navratri 2025 recorded India’s highest retail sales in 10 years, thanks to GST cuts on 375 items.

- Consumer Spending Boom: Analysts estimate tax cuts could fuel ₹96,000 crore in extra consumer spending, especially in fashion, QSR, and electronics.

- Short-Term Revenue Sacrifice: The government anticipates a ₹48,000 crore revenue dip, but expects inflation to drop by 1.1 points, spurring real demand.

- Category Uplift in Apparel: Textile demand jumped nearly 10% in Ahmedabad after garment GST dropped to 5% for products priced below ₹2,500.

In essence, GST 2.0 is more than a compliance update, it’s a demand accelerator.

Impacts and Tactical Imperatives for Retailers

1. Pricing Rework: Pass-Through or Protect Margins

New slabs create room to revisit pricing. The dilemma: transfer the benefit to customers or retain part of the margin?

- High-volume categories like FMCG may benefit from aggressive price cuts.

- Categories shifting from 28% → 18% enjoy margin flexibility.

- Bundled promotions (e.g., shampoo + conditioner) can leverage the “tax windfall.”

- Be cautious in exempt categories where input tax credit (ITC) isn’t available – margins may tighten.

2. SKU Rationalization and Category Mix

- Accelerate low-GST SKUs (e.g., toiletries, kitchenware).

- Prune or reprice 40% slab items to avoid inventory risk.

- Reclassify SKUs that moved drastically between slabs to ensure compliance.

3. Procurement and ITC Mapping

- Re-negotiate supplier terms based on reduced input tax.

- Recompute landed cost and adjust margin projections.

- Review transitional provisions carefully to avoid ITC loss.

4. Compliance and Risk Readiness

- Return Filing Rule Tightening: From July 2025, GSTR-3B has been auto-locking values from GSTR-1; edits are not allowed.

- Three-Year Filing Limit: Returns older than 3 years cannot be revised.

- ISD Registration mandatory for companies with multiple GST registrations.

- E-Invoice / E-Way Bill timelines and formats have changed.

Audit and classification accuracy are crucial. Missteps could invite penalties.

5. Marketing and CRM Strategy Alignment

Retailers should use this reform as a marketing opportunity.

- Highlight “Now at 5% GST” messaging across stores, websites, and campaigns.

- Launch tax-benefit themed promotions during the festive season.

- Use CRM analytics to segment customers who frequently purchase now-discounted products.

- Adjust loyalty rewards – Lower tax means more room for cashback or bonus points.

- Train retail staff to communicate pricing changes clearly at checkout.

6. Scenario Planning

- Run simulations across categories:

- 5% → 0% transition for essentials

- 28% → 18% for electronics and appliances

- Model “pass-through,” “partial,” and “retain margin” cases

- Adjust campaign budgets based on expected margin expansion

Key Risks to Watch

- Input Credit Mismatch: Zero-rated categories may lose ITC benefits.

- Classification Errors: Wrong slab allocation could trigger audits.

- Luxury Segment Contraction: 40% GST could dampen demand.

- System Lag: Ensure POS and ERP systems are updated for new rates.

- Consumer Perception Gap: If price drops aren’t clearly communicated, customers may perceive unfair pricing. Therefore, letting your customers know beforehand about the new pricings ensures fairness.

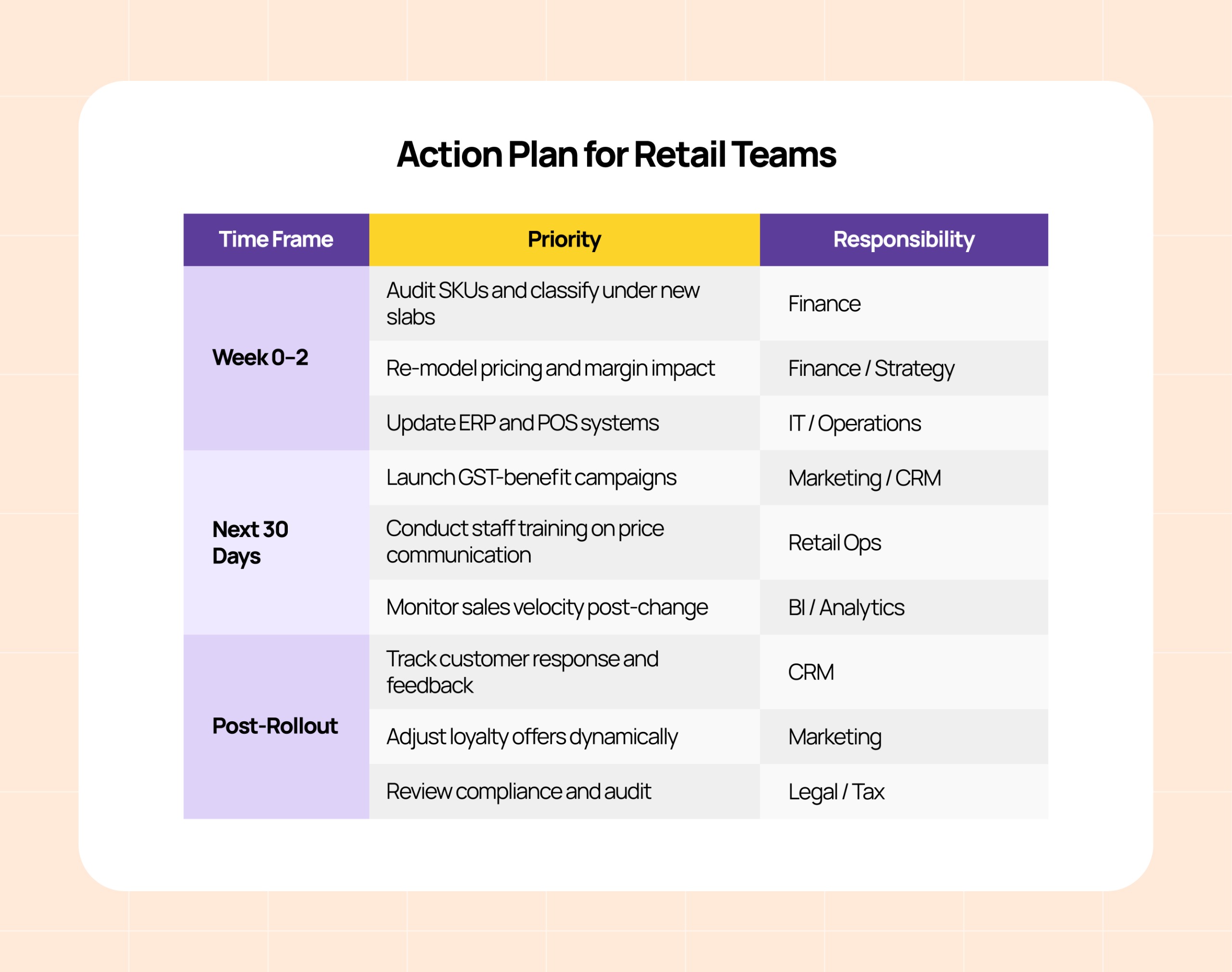

Action Plan for Retail Teams

The Bottom Line

GST 2.0 marks one of India’s most significant tax overhauls in years. The winners will be retailers who respond fastest – recalibrating prices, communicating transparently, and leveraging CRM intelligence to retain consumer trust.

At eWards, our role is to help retail partners turn these regulatory shifts into growth opportunities – from campaign intelligence to customer loyalty and performance tracking.

Because in 2025, clarity in compliance means confidence in commerce.

Read more : Maximize Retention, Revenue & Growth With Customer Lifetime Value