Mastering the BCG Matrix for Effective Customer Segmentation and CRM Strategy

Why do some businesses seem to know exactly what their customers want, while others miss the mark? It’s not magic—it’s data-driven strategy at work.

If you’re looking to take your business to the next level, understanding your customers is the first step. But how do you make sense of all the data you’ve collected over the years? How do you identify the customers who will drive your business forward versus those who may be holding you back?

Here’s where the BCG Matrix comes in. It is a powerful tool that helps you categorize your customers based on market share and growth potential, so you can focus on the right segments and maximize your return on investment.With the right approach, segmentation can lead to higher engagement, increased sales, and stronger customer loyalty. Let’s dive in and explore how the BCG Matrix can guide your next CRM decision.

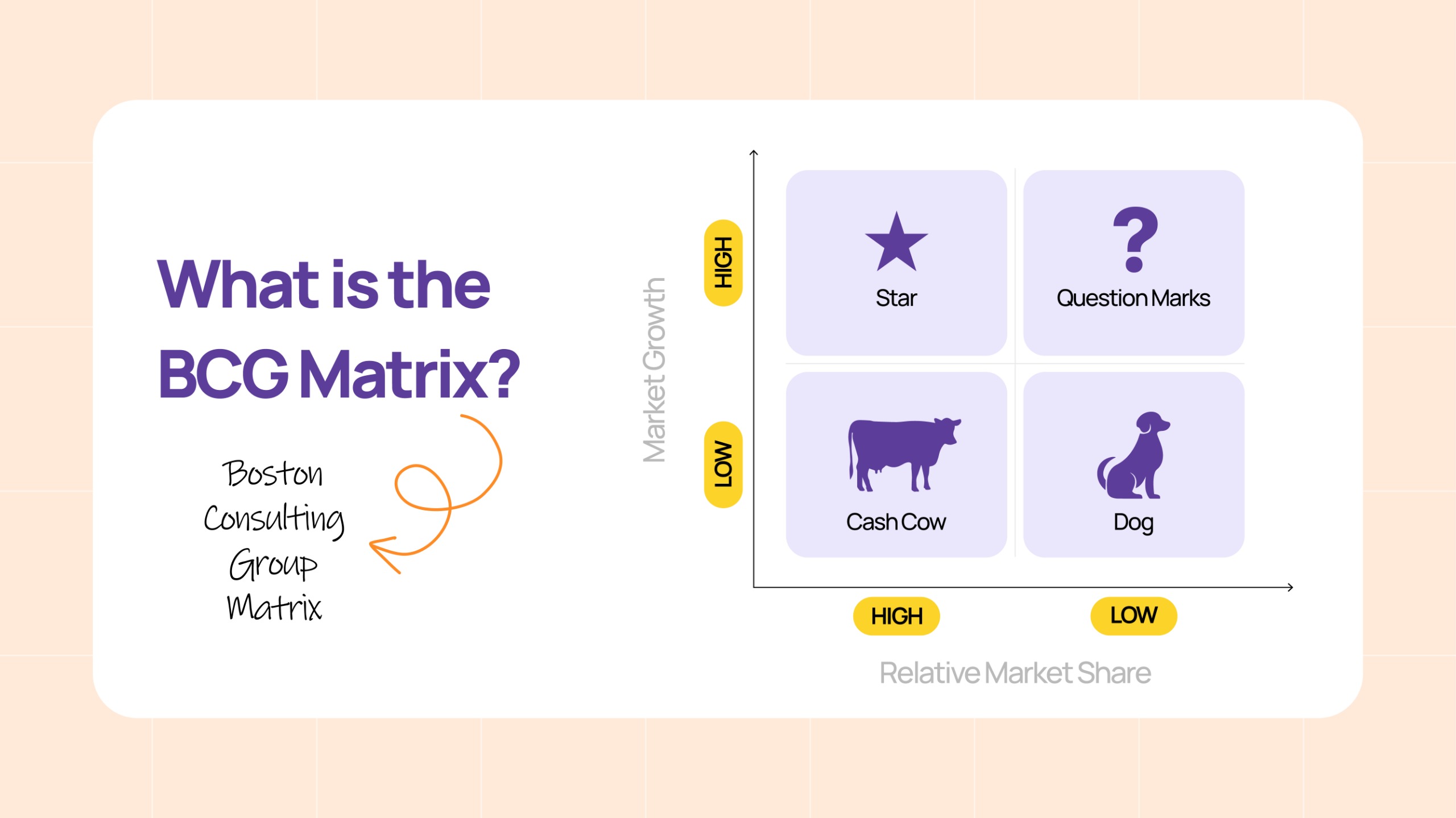

What is the BCG Matrix?

The full form of the BCG Matrix is the Boston Consulting Group Matrix. It is a strategic tool that categorizes a business’s customer segments and products depending upon two key factors: market share and growth potential. This matrix helps businesses assess their position in the market and make informed decisions about where to focus their efforts.

The BCG Matrix splits your customer segments into four distinct categories:

- Stars – High growth, high market share

- Cash Cows – Low growth, high market share

- Question Marks (Problematic Section) – High growth, low market share

- Dogs – Low growth, low market share

- Stars: Customer Segment that Drives Growth

Stars are your high-value, high-potential customers. These customers not only have a strong market share but are also in a fast-growing market. They are your brand advocates, loyal to your product or service, and help expand your business through word-of-mouth and repeat purchases.

Consider Apple and its iPhone customers. Apple maintains a strong market share among tech enthusiasts and continues to see growth in global sales year after year. These loyal customers are the “Stars” in Apple’s customer portfolio.

Strategy for Stars:

- Engage with exclusivity: Offer VIP treatment and personalized experiences, such as early access to new products or customized discounts.

- Expand and innovate: Ensure continuous product innovation and service improvements to retain their loyalty.

- Leverage their advocacy: Encourage these customers to refer others and promote the brand further.

- Cash Cows: Steady Revenue Providers

Cash Cows are your loyal, long-term customers that consistently contribute to your revenue but are in a low-growth market. While these segments don’t offer significant growth, they provide the stability your business needs, making them crucial to maintaining profitability.

Think of Coca-Cola. The brand’s core soda products represent Cash Cows—these customers aren’t growing as rapidly, but they’re still highly profitable and provide steady revenue.

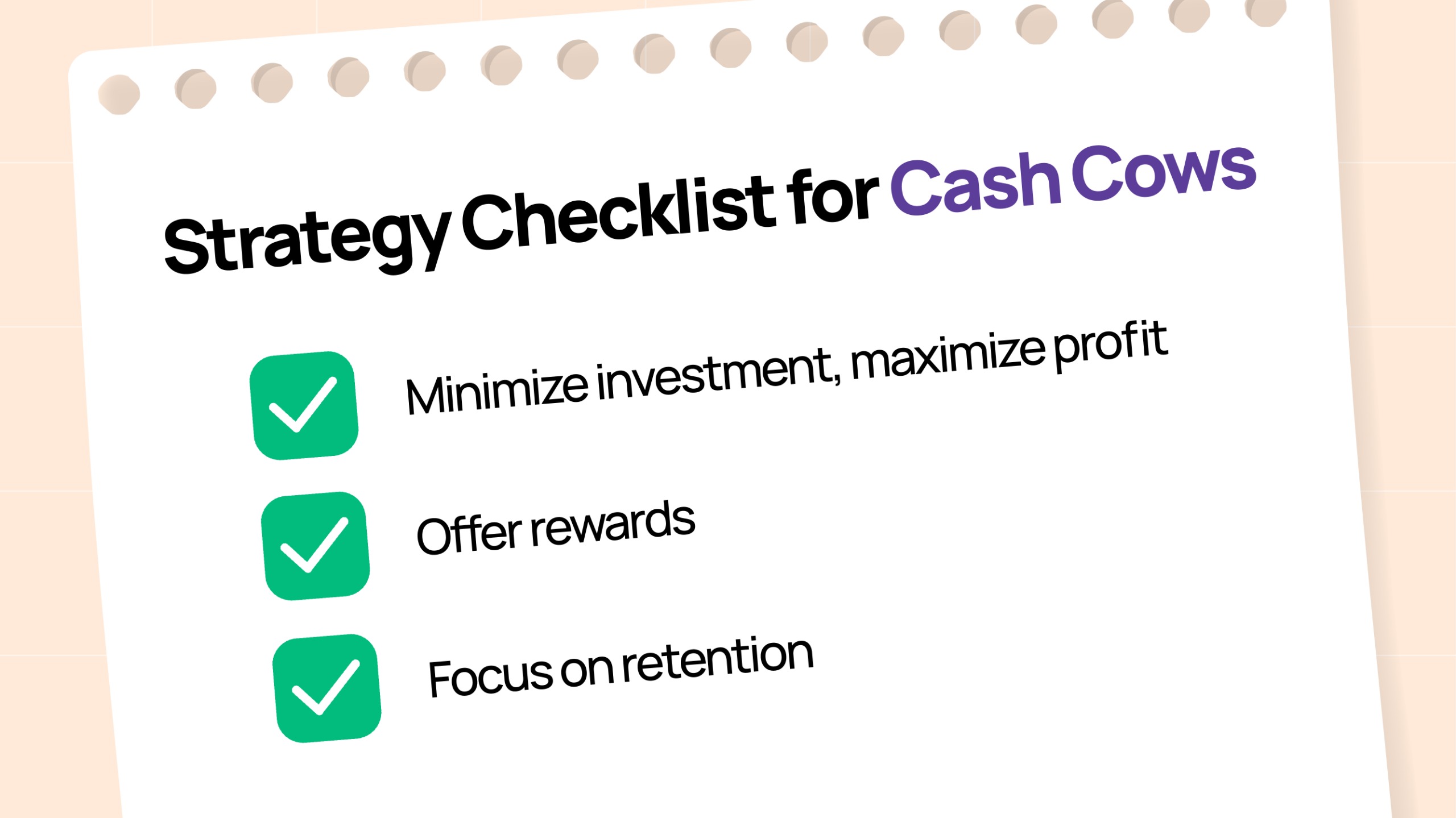

Strategy for Cash Cows:

- Minimize investment, maximize profit: Focus on efficient marketing and loyalty programs that maintain these customers with minimal cost.

- Offer rewards: Engage them with rewards programs that make them feel appreciated but don’t require heavy investment.

- Focus on retention: Ensure that these customers remain loyal, as they provide a large chunk of your revenue without needing continuous innovation.

- Question Marks: The High-Potential, Low-Market Share Segments

Question Marks represent customer segments that are in a high-growth market but currently have a low market share. These customers have the potential to become Stars if nurtured properly. However, they require more investment, innovation, and marketing attention to increase their market share.

Rivian, an electric vehicle manufacturer, has entered the electric vehicle (EV) market—a rapidly growing sector with immense potential. Despite the booming demand for electric cars, Rivian has a low market share compared to Tesla, Ford, BYD, Honda, and more, which are currently the dominant players in the EV space.

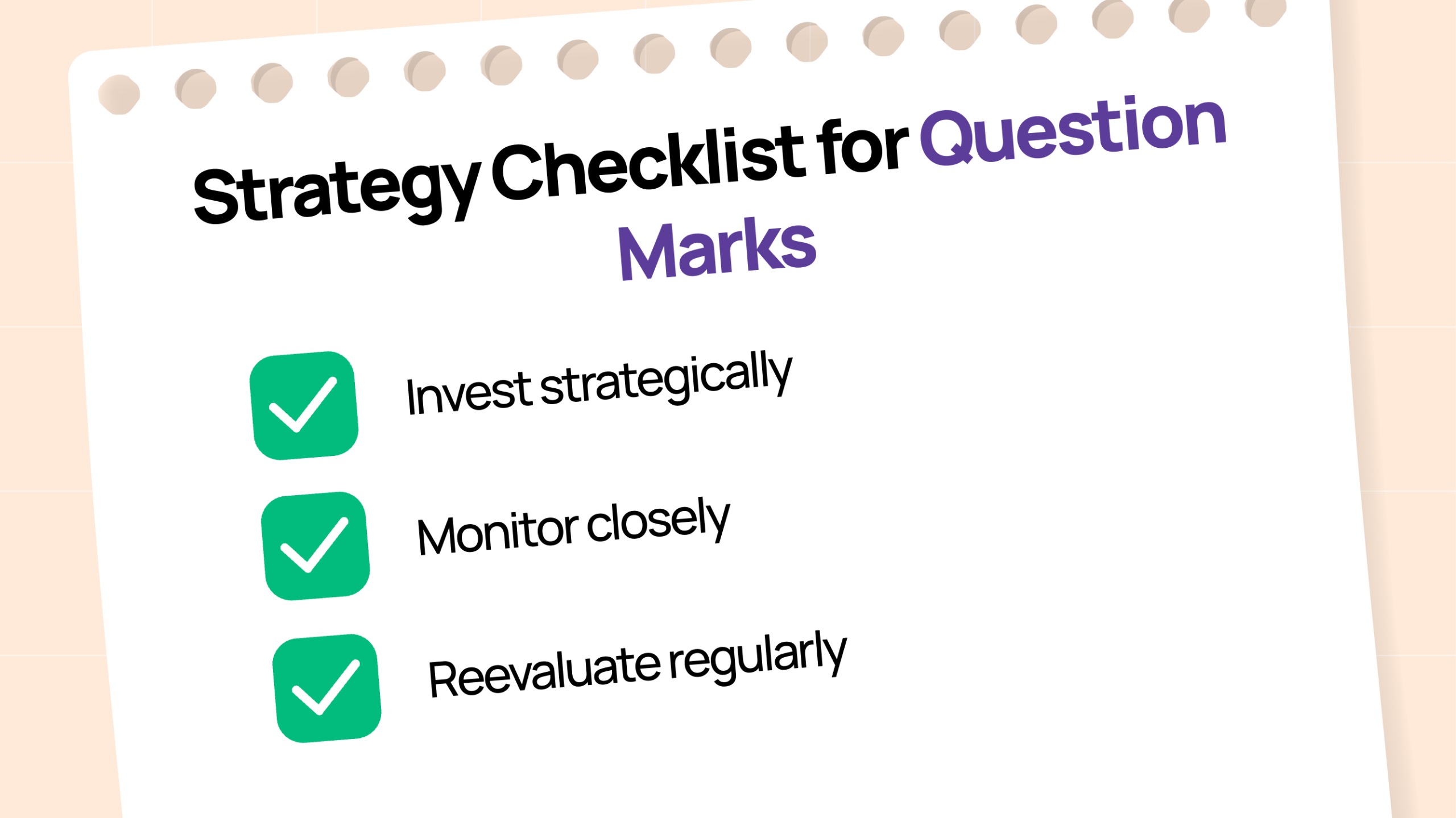

Strategy for Question Marks:

- Invest strategically: Focus on nurturing these segments with targeted campaigns, loyalty programs, and product enhancements.

- Monitor closely: Track their behavior closely and adjust strategies as they grow.

- Reevaluate regularly: After the investment, evaluate if they can transition into Stars or need to be phased out.

- Dogs: The Underperforming Segments

Dogs are customer segments that offer low growth and low market share. These customers often underperform and do not contribute meaningfully to your overall growth. They can drain resources without offering significant returns, making them candidates for either re-engagement or phase-out.

BlackBerry was once the leader in the smartphone market, known for its security features and physical keyboards. While the company still exists, it no longer plays a significant role in the smartphone industry, and its market share has dropped to nearly zero. The smartphone market, once a high-growth sector for BlackBerry, is now slow and oversaturated, and BlackBerry’s product offerings are no longer competitive in the face of Apple and Samsung.

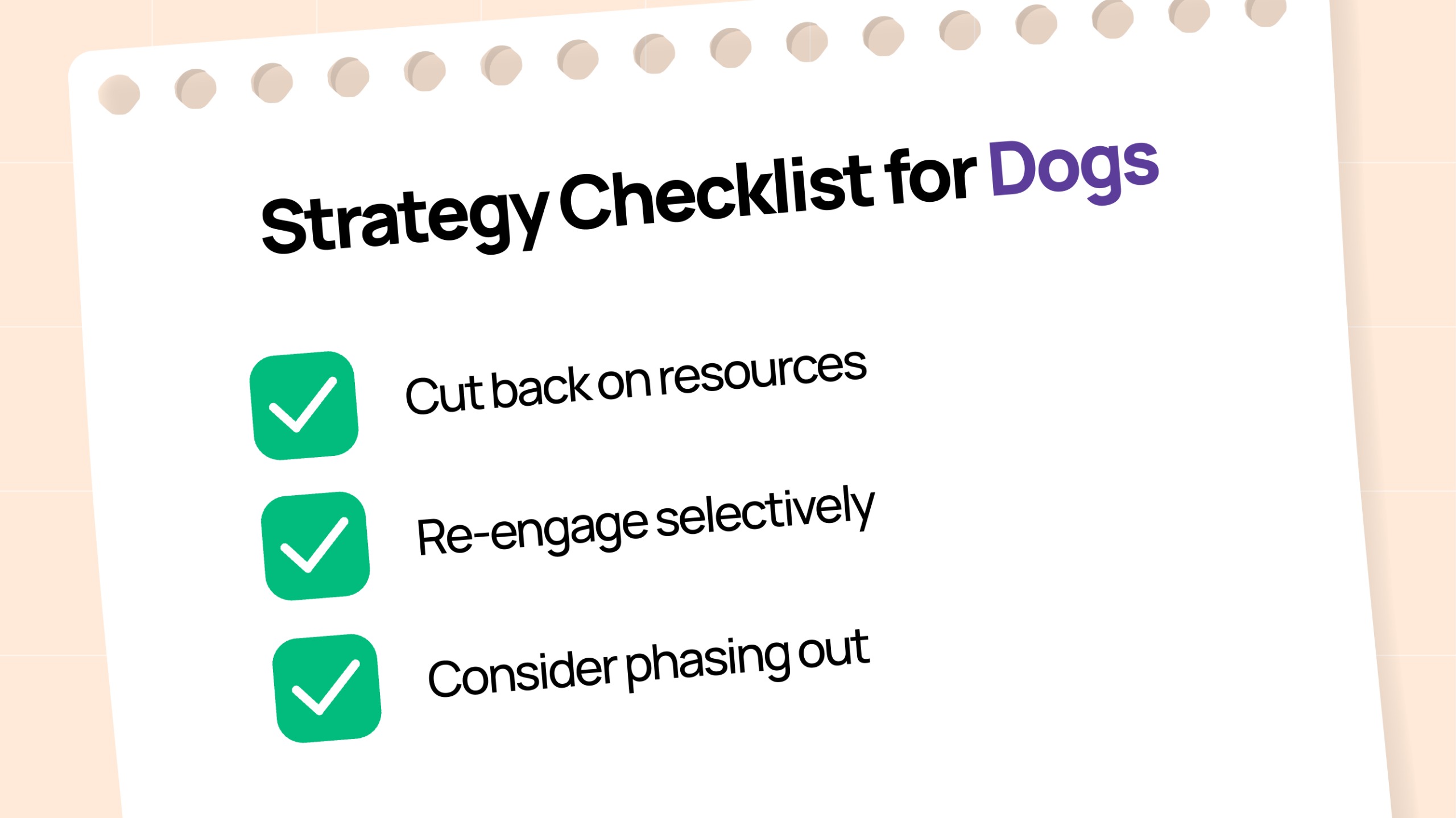

Strategy for Dogs:

- Cut back on resources: Minimize efforts and resources spent on engaging with this segment.

- Re-engage selectively: Consider targeted, low-cost campaigns or discounts to see if their behavior can improve.

Consider phasing out: If they remain unprofitable, it may be wise to reallocate resources to more promising segments.

Implications of BCG Matrix on CRM & Your CRM Strategy

The BCG Matrix provides valuable insight into how you should manage your customer relationships. You can evaluate your customer segments and create a tailored CRM strategy for each category, making sure that you invest your resources wisely.

Here’s how the matrix can impact your CRM approach:

- Tailored Strategy for Every Segment

- Stars – Focus on strengthening relationships with personalized engagement strategies. Provide exclusive deals and reward systems to keep them loyal and encourage advocacy.

- Cash Cows: Efficient communication will be an effective strategy for nurturing their loyalty. But businesses need to make sure that it is without overwhelming them with constant new offers. A key to keeping them happy is providing value-based rewards.

- Question Marks: Use targeted nurturing campaigns, personalized offers, and educational content to turn them into Stars. Invest in customer onboarding and continuous engagement.

- Dogs: Implement low-cost engagement strategies or consider phasing them out from your CRM efforts if they no longer contribute to revenue.

- Data-Driven CRM Decisions

BCG Matrix allows you to make data-driven decisions. You can concentrate on how to allocate your CRM resources and use your customer data to determine which segments need higher touchpoints and which ones can be maintained with less effort.

- Cross-Channel CRM Segmentation

Your CRM strategy should be consistent across all platforms, whether that’s email, SMS, or social media. The BCG Matrix helps prioritize which segments deserve multi-channel engagement and which should receive targeted, cost-effective interactions.

- Focus on Customer Retention

By identifying your Stars and Cash Cows, you can focus more on retention strategies rather than constantly acquiring new customers. Making sure that you keep your best customers engaged will help drive long-term profitability and reduce churn.

Measuring Success in Customer Segmentation

Customer segmentation is just the beginning. The real challenge lies in how you engage and retain these segments to drive business growth. Let’s explore how to measure the effectiveness of your segmentation strategy so that you allocate your resources wisely.

- Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) is one of the most crucial metrics in measuring the effectiveness of your segmentation strategy. It represents the total revenue or profit a customer generates for your business throughout their relationship with you.

Why it matters:

By tracking CLV across your Stars, Cash Cows, Question Marks, and Dogs, you’ll get a clear picture of which segments contribute the most value to your business. It’s essential to assess whether your high-growth segments (Stars and Question Marks) are indeed bringing in long-term value or if they’re just a one-time spike in sales.

How to measure it:

- For Stars, you should see a high CLV due to their loyalty and repeat purchases. If the CLV doesn’t match expectations, it might indicate that your retention strategies aren’t as effective as they could be.

- For Cash Cows, the CLV should be steady, but not growing at the same pace as your Stars. This indicates that these segments are still highly profitable, even if they aren’t growing much.

- The CLV for Question Marks might still be low, but with the right investments and engagement strategies, this figure can skyrocket as they transition into Stars.

- For Dogs, if their CLV is consistently low, it’s a red flag to either re-engage them with better offers or consider shifting your resources elsewhere.

- Customer Retention Rate

The Customer Retention Rate (CRR) measures the percentage of customers that continue buying from you over a given period of time. It’s particularly useful in understanding how well your engagement efforts are working.

Why it matters:

A high retention rate is expected for your stars. They should keep coming back, and your goal is to ensure they stay loyal and become even more engaged. If the retention rate drops, you’ll need to reevaluate your engagement tactics—whether it’s personalized offers, loyalty rewards, or exclusive experiences.

How to measure it:

- Track the number of returning customers over a defined period (e.g., monthly, quarterly).

- Compare retention rates between segments. For Cash Cows, maintaining a stable retention rate is key. For Question Marks, your goal should be to increase retention by investing in customer loyalty programs or engagement activities that encourage repeat purchases.

- Customer Acquisition Cost

Customer Acquisition Cost (CAC) refers to the total cost incurred to acquire a new customer. It includes everything from marketing spend to sales efforts.

Why it matters:

If you’re spending too much to acquire new customers, especially in the Question Mark or Dog segments, it could lead to unsustainable growth. A high CAC relative to the value generated from that customer means you’re not getting the ROI you should be from your marketing and sales efforts.

How to measure it:

- Calculate how much you are spending to acquire each customer. Compare the CAC for Stars, Cash Cows, and Question Marks.

- For Stars, you should aim for a low CAC since they’re loyal and easy to convert into repeat customers. For Question Marks, you may need to invest more upfront, but the key is to track whether your acquisition costs are reducing over time as you transition them into loyal customers.

- Engagement Metrics

Engagement metrics refer to how customers interact with your business, whether through emails, social media, loyalty programs, or purchases. This is an important indicator of how much your customers care about your brand.

Why it matters:

The more engaged your customers are, the more likely they are to stick around, recommend your brand to others, and spend more. For Stars, engagement should be high and frequent, showing they are active participants in your brand’s ecosystem. For Cash Cows, engagement may be less frequent but still important for retaining their loyalty.

How to measure it:

- Open rates, click-through rates (CTR), and social media engagement (likes, shares, comments) are great indicators of how actively engaged your customers are.

- Track the frequency of visits or purchases among your segments. For Stars, these numbers should be consistent and growing, while for Cash Cows, a steady rate is ideal. For Question Marks, you should focus on increasing engagement to build loyalty.

- ROI of Marketing Campaigns

The Return on Investment (ROI) for your marketing campaigns measures the profit or loss generated from your marketing efforts. It’s an essential metric to track whether your investment in customer segmentation is generating value.

Why it matters:

With Question Marks, you want to ensure that your marketing spend is effective. For Stars and Cash Cows, you’re looking to maintain high ROI through loyalty programs, exclusive campaigns, and other personalized strategies.

How to measure it:

- Calculate the ROI of your campaigns and compare them across different customer segments.

- Stars should generate higher ROI due to personalized campaigns and customer loyalty.

- For Question Marks, if the ROI is lower, evaluate if your strategies are effectively targeting the right audience, and adjust your campaigns accordingly.

Pitfalls of Using BCG Matrix

While the BCG Matrix is a powerful tool for customer segmentation, it’s not without its limitations. As with any framework, it’s essential to be aware of potential pitfalls to make sure that you’re not making decisions based on oversimplified analysis.

- Oversimplification of Complex Customer Segments

The BCG Matrix classifies customers into just four categories—Stars, Cash Cows, Question Marks, and Dogs. While this simplicity is helpful for quick analysis, it can oversimplify the complexities of real-world customer behavior.

Why it matters:

In reality, customers may not always fit neatly into one of these categories. For example, a Question Mark might show growth potential, but their behavior could also show signs of plateauing. Likewise, a Cash Cow may have some aspects of a Dog—for example, declining interest from a key demographic.

How to mitigate it:

While the matrix provides a framework, make sure to integrate qualitative insights from customer feedback, sales trends, and competitor analysis. Use the matrix as a starting point, but supplement it with a deeper analysis of customer needs and market dynamics.

- Ignoring External Factors

The BCG Matrix primarily focuses on market share and growth potential, but it doesn’t account for external factors like economic changes, competition, or market disruptions.

Why it matters:

For example, a Star segment in one year could be reduced to a Dog if market conditions shift, like the emergence of new competitors or economic downturns. Ignoring these factors could lead to missed opportunities or misplaced resources.

How to mitigate it:

It is important to consider macroeconomic factors, consumer trends, and competitive analysis when applying the BCG Matrix. Therefore, regularly revisit and update your analysis based on shifts in the external environment.

- Lack of Long-Term Focus

The BCG Matrix tends to focus on short-term market share and growth potential, which may lead businesses to overlook the long-term development of their customer base. It encourages focusing on current performance rather than future growth trajectories.

Why it matters:

For example, a Question Mark may require investments in innovation and engagement that will pay off in the long run. Relying too heavily on short-term market share may hinder you from nurturing high-potential segments that could provide substantial returns over time.

How to mitigate it:

Balance your short-term performance analysis with a focus on long-term goals. Don’t just allocate resources based on immediate results. Invest in segments that show future promise, and ensure your long-term strategy supports the continued growth of Question Marks.

- Misinterpretation of Growth & Market Share Dimensions

The BCG Matrix assumes that high market share and high growth potential are always positive. However, businesses may misinterpret these dimensions or prioritize the wrong factors. For instance, a customer segment with high market share but diminishing growth potential may still be categorized as a “Star,” when in fact, it could be a Cash Cow that requires less investment.

Why it matters:

A high market share doesn’t always indicate future success. Similarly, growth potential is often speculative and may not always be sustainable. This can lead to poor allocation of resources.

How to mitigate it:

Incorporate other business metrics, like customer satisfaction, brand loyalty, or revenue per customer, into your analysis. Don’t rely solely on market share and growth potential—these are just indicators, not definitive measures of success.

- Failing to Account for Customer Lifecycle

The BCG Matrix doesn’t take into account the entire customer lifecycle. For example, a Cash Cow might be in a low-growth phase, but it could still be in the mature phase of its lifecycle, with potential for revival through new marketing strategies.

Why it matters:

Treating a mature customer segment as a Dog without considering its lifecycle may lead you to prematurely phase it out or fail to innovate. Conversely, a Question Mark could show signs of stagnation because of early lifecycle stages, not necessarily because it lacks potential.

How to mitigate it:

Consider the stage in the customer lifecycle when applying the BCG Matrix. A customer in the mature phase of the lifecycle might require strategies different from those that are still in the growth phase. Use a combination of tools (like the Customer Lifecycle Stage framework) to ensure you account for both market dynamics and the customer journey.

- Overemphasis on Resource Allocation

The BCG Matrix encourages businesses to focus on resource allocation based on current market share and growth potential. While this is useful for strategic decision-making, businesses may overemphasize immediate resource allocation and miss opportunities for market diversification or innovation.

Why it matters:

By focusing only on the segments with high growth potential, businesses may overlook the importance of other strategic initiatives, such as product diversification or entering new markets. This short-term focus could limit long-term business expansion.

How to mitigate it:

Use the BCG Matrix as a guide, but also consider other growth strategies, such as innovation, market diversification, and partnerships—balance resource allocation with investments in future opportunities outside the current matrix categories.

Conclusion

The BCG Matrix empowers businesses to make smarter, data-driven decisions about their customer segments. By understanding where your customers lie within the matrix, you can uncover new growth opportunities, optimize resource allocation, and elevate your CRM strategy to drive deeper loyalty and higher profitability.

But the key is action. It’s not enough to just know where your customers fall; you must actively invest in the right segments, nurture your Stars, maximize your Cash Cows, and strategically grow your Question Marks. Dogs may need a re-evaluation, but that doesn’t mean you should abandon them outright—they could surprise you with the right strategy.

So, where do you start? Take a closer look at your current customer segments—where are your Stars shining bright, and where are your Question Marks waiting for the right investment to soar? It’s time to optimize your CRM and move your business towards sustained growth.