What you measure is what you improve.

Why do some loyalty programs create lifelong customers while others fizzle out in months? Building a loyalty program isn’t just about rewarding customers—it’s about making deeper connections, inspiring brand devotion, and driving sustainable growth. Yet, the real question is: how do you measure whether your program is delivering these outcomes or silently failing?

The key lies in tracking the right metrics. Without them, even the best-designed programs risk missing the mark.

In this blog, we’ll uncover the essential KPIs that separate thriving loyalty programs from the ones that fail and provide actionable insights to ensure your program exceeds customer expectations.

Loyalty Program KPIs: The Metrics that Define Success

Loyalty Program KPIs, or Key Performance Indicators, are measurable metrics that assess the success and impact of a loyalty program. They provide a clear, data-driven way to understand how well your program is performing, identify areas for improvement, and determine whether it’s achieving its goals.

These KPIs go beyond vanity metrics like sign-ups; they dig into the program’s actual effectiveness by tracking customer behavior, financial outcomes, and program engagement. They answer critical questions like:

- Are customers returning to your brand more frequently?

- Are they redeeming rewards, or are points going unused?

- Is your loyalty program contributing to overall profitability?

By consistently monitoring these KPIs, businesses can refine their loyalty strategies, optimize rewards, and create a program that not only attracts members but keeps them engaged for the long term.

Key Metrics for Measuring the Success (or Failure) of the Loyalty Program

- Customer Retention Rate (CRR)

The customer retention rate is defined as the percentage of customers that remain with the brand over a long period. It helps the brand understand the reason behind their loyalty to the company while also providing an opportunity to enhance services.

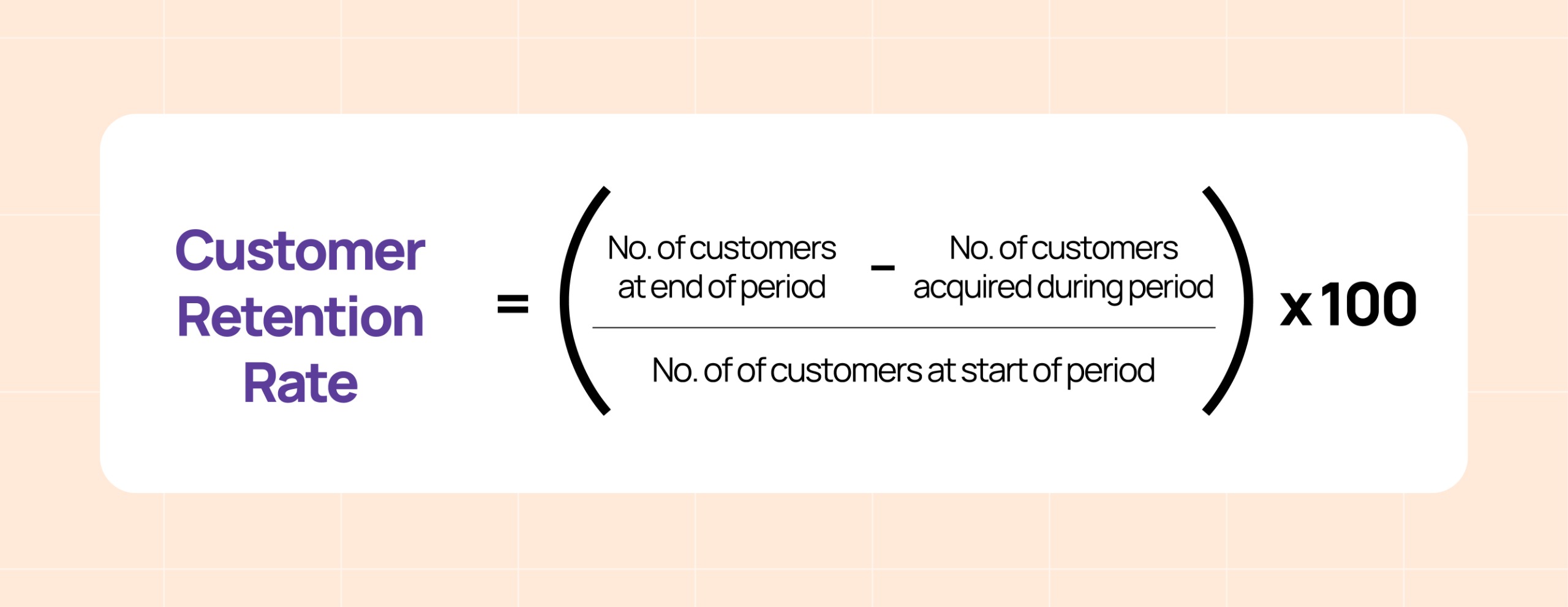

Customer Retention Rate formula:

Why does it matter?

According to NG data, customer retention management is up to 7x less costly than customer acquisition. This is because making sales to existing customers is far more effective as you would not have to convert them from scratch. Besides that, customer satisfaction, upselling, and cross-selling are more lucrative for the existing customer than for whatever sale you make to a new client.

How can it be improved?

- Personalization – Email campaigns can be tailored with exclusive offers and reminders for re-engaging inactive members

- Gamification of Engagement – Brands can introduce tiered rewards or challenges to keep the customers hooked and they come back

- Redemption Rate

It is defined as the percentage of rewards or points that are earned by loyalty program members that are available for use or to be redeemed. It is a crucial metric that is known to quantify the effectiveness of customer engagement initiatives.

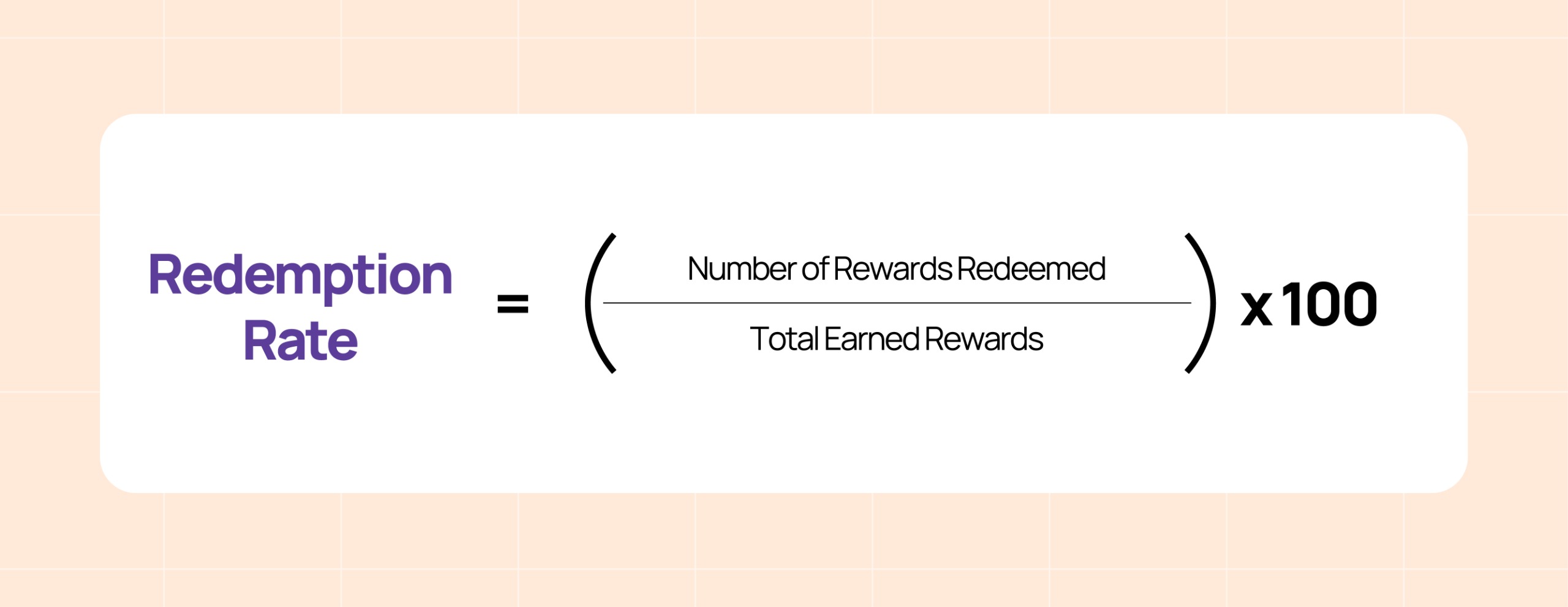

Redemption Rate Formula:

Why does it matter?

Understanding redemption rates is important for marketing strategy. With the correct value, brands can assess the performance of their reward programs while also identifying their potential weaknesses. It also helps in optimizing the loyalty program to maintain customer loyalty.

How can it be improved?

- Simplification of reward redemption: The brands need to make sure that customers redeem rewards easily whether offline or online

- Experiential Rewards: The addition of unique experiences like VIP access allows customers to redeem their rewards more often

- Customer Lifetime Value

Customer Lifetime Value (CLV or CLTV) is the total net profit that a company expects to generate from a customer throughout their relationship with the brand. It considers the initial purchase of the customer, their repeat purchases, and the time they hold a relationship with the company.

Customer Lifetime Value Formula:

Why does it matter?

This is one of the most important metrics to know which provides the long-term picture of the business along with the financial stability of the brand. For instance, a brand that has high CLV means that its product is market fit which enhances brand loyalty and recurring revenue from existing customers.

How can it be improved?

- Upselling and Cross-selling: Brands can provide personalized recommendations for different products and services depending on the purchase history of their customers

- Loyalty Tiers: The creation of exclusive tiers with premium rewards can incentivize high-value members to spend more

- Enrollment Rate

In the B2B context, Enrollment Rate refers to the number of customers that have enrolled in your customer loyalty program. It is often calculated by dividing the number of enrolled customers by the total number of customers a brand has.

Enrollment Rate Formula:

Why does it matter?

The enrollment rate is a very critical metric that can successfully assess the Loyalty Program’s initial appeal as well as perceived value. For instance, a low enrollment rate can indicate that the program lacks appeal or awareness.

How can it be improved?

- Highlight Program Value: Brands can promote their loyalty program via banners, in-store prompts, as well as social media where they can highlight the benefits of joining the program.

- Leveraging Partnerships: Brands can collaborate with complementary other brands to enhance the reach of their Loyalty Programs.

- Active Participation Rate

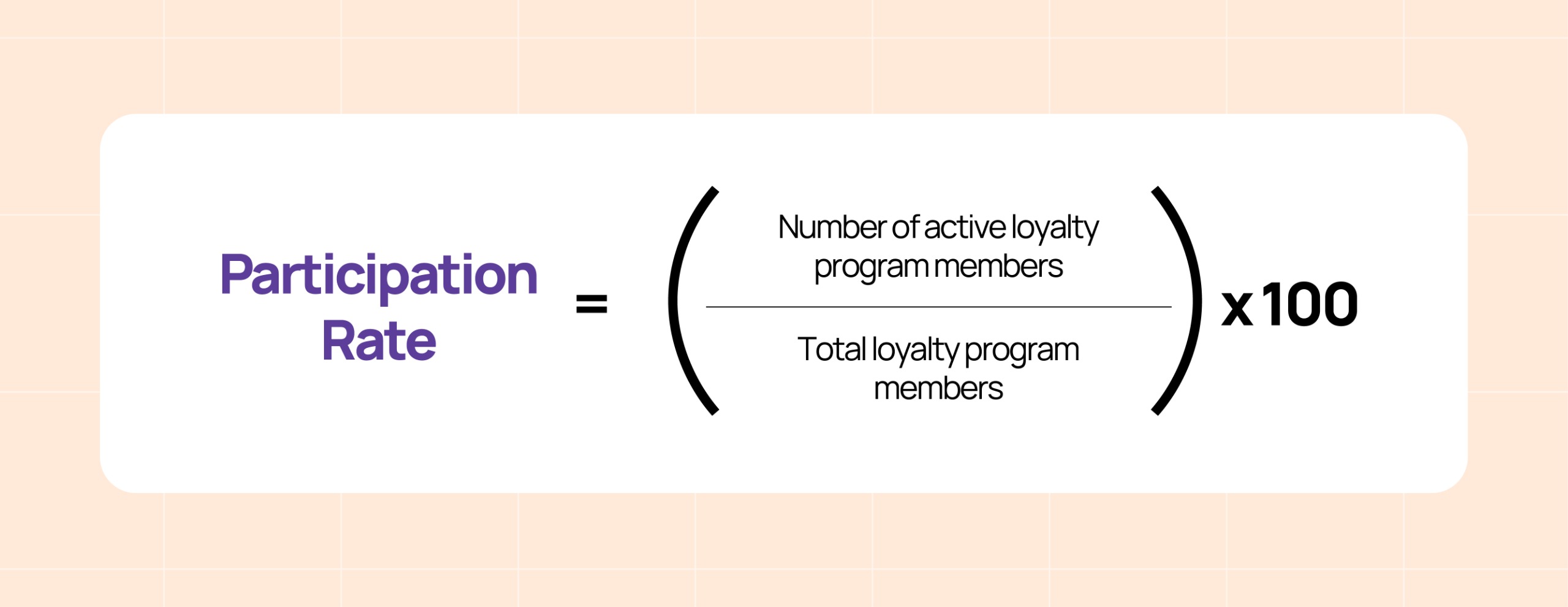

Active Participation Rate in Loyalty Program refers to the percentage of customers that are already enrolled in the loyalty program of the company and are actively participating in it. It is calculated by dividing the number of active customers by the total number of enrolled customers which is then multiplied by 100.

Why does it matter?

By knowing the exact value of active participation rate brands can find out whether their program is valuable or not or if the customers enjoy interacting with your brand. If the active participation rate is high, then the retention rate will also be high because the customers who are engaged are more likely to remain loyal to your brand.

How can it be improved?

- Engagement Campaigns: Brands can run campaigns where they offer bonus points for referrals and purchases

- Omnichannel Access: In this digital era, brands need to make sure that their customers can seamlessly participate across every platform (including app, website and in-store)

- Repeat Purchase Rate

The repeat purchase rate (RPR) is essential for measuring the frequency of customers returning to a brand to make a purchase. It can be calculated by dividing the number of repeat purchase customers.

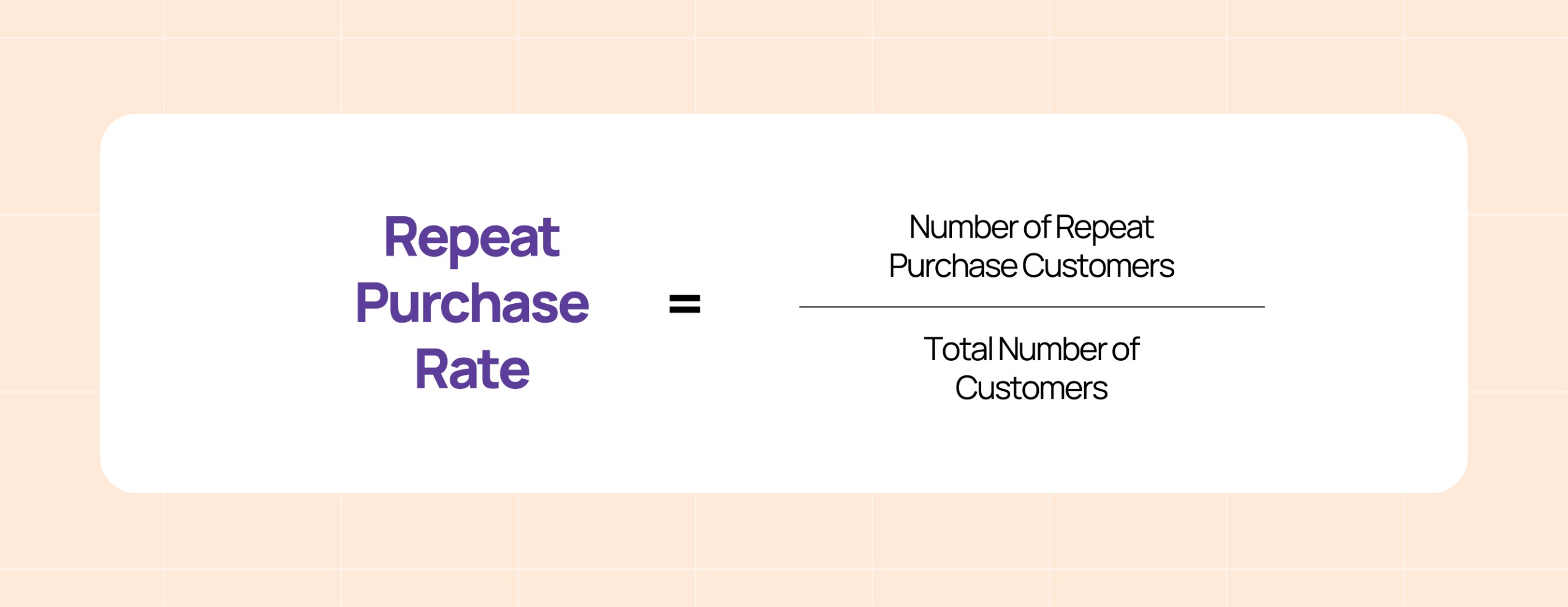

Repeat Purchase Rate Formula:

Why does it matter?

This KPI is an essential indicator of customer satisfaction and loyalty which also allows the brand to track the success of their customer retention strategies. By understanding this metric you can refine and target your marketing and customer service efforts to retain existing customers and increase loyalty.

- A high repeat purchase rate means that the customers are returning to buy products from your business which in turn highlights that the customers are satisfied with your products and are loyal to your brand.

- Whereas a low RPR highlights that customers are not finding value in your product and need some convincing to return back

How can it be improved?

- Personalizing Offers: To bring your customers back, you should tailor your rewards and offerings depending upon the needs and expectations of the customers.

- Tiered Incentives: Brands should also encourage frequent purchases by providing better rewards for consistent shopping behavior.

- Referral Rate

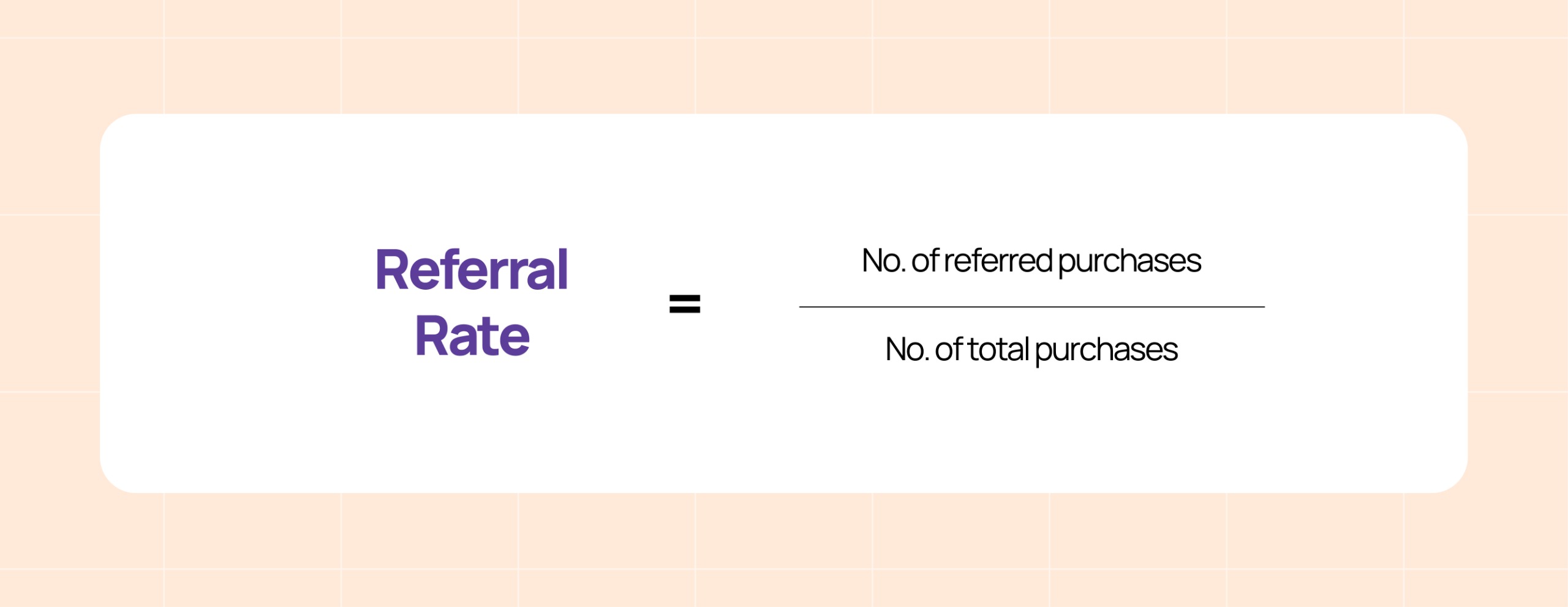

It refers to the percentage of individuals who are referred to a business or organization by the existing loyalty program members. It is ideally calculated by dividing the number of referred purchases by the total number of purchases.

Referral Rate Formula:

Why does it matter?

This KPI is important for understanding the value that your customers hold for your brand. For instance, a high referral rate shows that a large number of new loyalty members are acquired from referrals. This, then, acts as a positive indicator of consumer trust and satisfaction.

How can it be improved?

- Double-sided Rewards: Brands can improve their referral rate by providing incentives to both the referrer and the referee

- Social Sharing: To enhance engagement in your loyalty program, you can simplify the referral process via social media and email

Analysis of Metrics – To Turn Data into Actionable Insights

Analyzing metrics isn’t just about identifying problems—it’s about turning insights into strategies that drive measurable improvements. By tracking trends, segmenting data, and understanding metric correlations, experts can design programs that are not only more effective but also more responsive to customer needs.

- Identification of Trends Over Time

Metrics aren’t static—they fluctuate based on customer behavior, marketing efforts, and external factors. By tracking metrics month-over-month or quarter-over-quarter, you can uncover patterns that reveal what’s working and what needs improvement.

- Identifying trends helps you understand whether your program is improving, stagnating, or declining. For example, a steady increase in redemption rates might indicate growing customer engagement, while a sudden drop in participation could point to friction in your program’s usability.

How to do it?

- Compare seasonal or annual data to identify cyclical patterns, such as increased engagement during holidays.

- Track metrics before and after significant changes, such as introducing a new reward tier or launching a promotional campaign.

- Use visualization tools like line graphs to monitor trends over time for metrics like retention, redemption, and enrollment rates.

- Segmenting Metrics by Demography

Not all customers engage with loyalty programs in the same way. Segmenting your metrics by demographics—such as age, location, gender, or spending habits—can help you understand which customer groups respond best to your program and where you might need to adjust your strategy.

- Segmentation provides granular insights, enabling you to tailor your program to the unique preferences of different customer groups. For instance, Gen Z might prefer gamified rewards, while Baby Boomers value simplicity and straightforward discounts.

How to do it?

- Use customer data to divide your audience into meaningful segments (e.g., high spenders, infrequent shoppers).

- Identify underperforming segments and investigate the reasons behind their disengagement.

- Analyze each segment’s metrics, such as redemption rates, participation levels, or lifetime value.

- Correlate Metrics to Understand Interdependencies

Loyalty program metrics are interconnected, and changes in one metric often influence others. For example, improving redemption rates can lead to higher retention and participation rates because customers see immediate value in the program. Correlating metrics allows you to understand these relationships and prioritize efforts where they’ll have the greatest impact.

- It helps you identify cause-and-effect relationships, making it easier to predict the outcomes of your strategies. For example, if higher redemption rates consistently lead to increased repeat purchases, you know that making rewards more accessible could drive more frequent transactions.

How to do it?

- Use tools like regression analysis to quantify the relationship between metrics.

- Compare related metrics, such as retention rates and redemption rates, over the same periods.

- Conduct A/B testing to isolate the impact of specific changes on multiple metrics.

Conclusion

Tracking these Loyalty KPIs provides a comprehensive view of its performance. Therefore, it allows you to refine your strategies, enhance customer engagement, and ensure long-term profitability.

By analyzing and acting on these metrics, you can build a loyalty program that delivers value to both customers and your business.