Customer retention remains a top priority for businesses worldwide, yet it’s often overlooked until it’s too late. According to a recent report by Bain & Company, increasing customer retention rates by just 5% can boost profits by 25% to 95%. This staggering statistic highlights why early detection and prevention of churn is critical.

The concept of Churn Risk Curve is built upon the well-established Pareto Principle and Cohort Retention Models, which offer a statistically sound framework to identify customers at risk of dropping off, thereby enabling targeted interventions before losses impact your bottom line.

What is Churn Risk?

The Churn Risk is a predictive model that highlights the likelihood of customer attrition over time. It tracks how engagement declines across different customer groups or cohorts, helping businesses identify when and which customers are most likely to churn. The idea combines:

- Pareto Principle (80/20 Rule): Where roughly 20% of customers drive around 80% of revenue. Protecting this vital minority is critical.

- Cohort Retention Models: Segmenting customers based on acquisition periods and tracking their retention patterns over time.

Together, these models map retention trends and highlight risk windows where customers begin to disengage, forming a curve that signals rising churn risk.

Why Does It Matter?

Retention is the key aspect of profitability. According to the CustomerGauge Study, the average customer retention rate in retail is 63%, and others churn annually. Yet, acquiring a new customer can cost 5 to 25 times more than retaining an existing one.

The Churn Risk Curve enables businesses to:

- Pinpoint when customers become at-risk (e.g., 30 days after last purchase)

- Understand which cohorts or segments are most vulnerable

- Deploy personalized campaigns and incentives before churn happens

Segment Health For Growth

Segmenting customers by their health status allows businesses to allocate marketing resources more efficiently:

- Active Customers: Engage with regular communications and loyalty incentives to deepen relationships.

- At-Risk Customers: Implement targeted re-engagement campaigns, personalized offers, or feedback collection to win them back.

- Lost Customers: Analyze churn reasons for product/service improvements and potential win-back opportunities.

Early identification of these segments means interventions happen before customers drop off, reducing revenue leakage and increasing lifetime value (LTV).

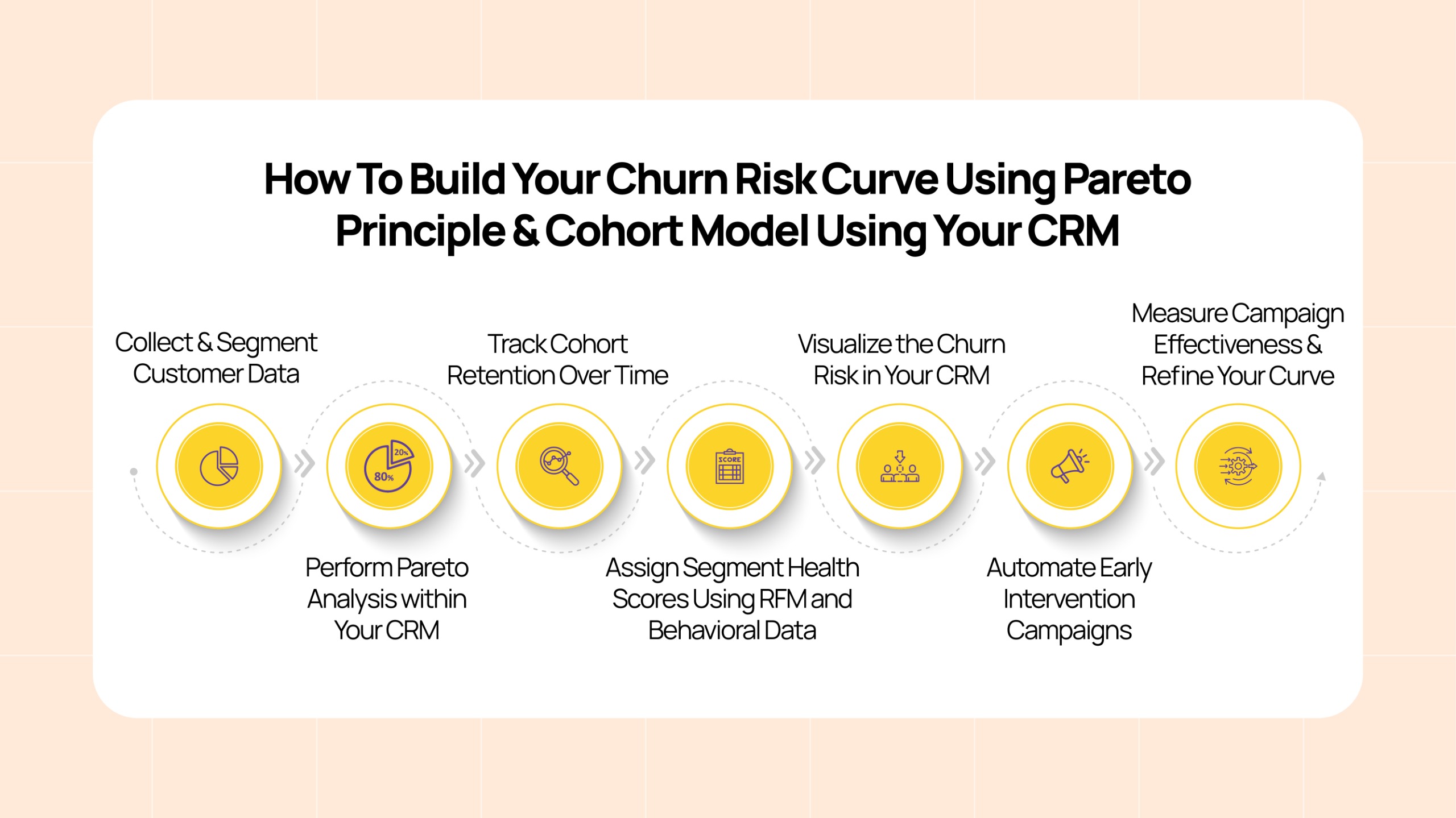

How To Build Your Churn Risk Curve Using the Pareto Principle & the Cohort Model Using Your CRM

The CRM systems are designed to collect, organize, and analyze vast amounts of customer data, making them ideal platforms to build and utilize the Churn Risk Curve. Here’s how you can leverage your CRM to develop this powerful retention tool:

- Collect & Segment Customer Data

Your CRM stores detailed customer records including purchase history, engagement events, demographics, and more. You can use these data points to:

- Identify Customers and Their Revenue Contribution: Extract total spend per customer to perform a Pareto Analysis. Your CRM reporting tools can help rank customers by revenue contribution.

- Create Customer Cohorts: Segment customers by acquisition date (e.g., month or week of first purchase) or by other meaningful criteria like acquisition channel, product category, or location. Many CRMs offer automated cohort grouping or let you build custom filters for this.

- Perform a Pareto Analysis within Your CRM

Using your CRM’s analytics or integrated BI tools:

- Generate a Pareto Chart that visualizes what percentage of your customers account for the majority of revenue.

- Identify the top 20% revenue contributors — your “vital few” customers.

- Tag or label these customers in the CRM for focused tracking and campaigns.

Why this matters: Prioritizing high-value customers allows you to tailor retention efforts where they’ll have the greatest financial impact.

- Track Cohort Retention Over Time

Your CRM tracks customer interactions over time, enabling you to:

- Measure retention rates for each cohort at intervals such as 7, 30, 60, 90, and 180 days.

- Visualize cohort performance trends through dashboards or custom reports.

- Detect drop-off points where engagement declines, which are the critical “risk windows” on your churn curve.

Example: If a cohort acquired in January shows a 70% retention at 30 days but drops to 40% at 60 days, your CRM can alert you to intervene before more customers churn.

- Assign Segment Health Scores Using RFM and Behavioral Data

Most CRMs support customer scoring models using parameters like:

- Recency: How recently did the customer make a purchase?

- Frequency: How often do they buy or engage?

- Monetary: How much do they spend?

Combine these with engagement data (email opens, website visits) to assign a health score or risk category:

- Active: Recent, frequent, and high-spending customers.

- At-Risk: Customers showing decreased frequency or no recent activity.

- Lost: Customers inactive beyond a threshold (e.g., 60+ days).

CRM automation can update these scores dynamically based on real-time data.

- Visualize the Churn Risk in Your CRM

With cohorts segmented and health scores assigned, use your CRM’s reporting features or BI integrations to:

- Plot retention rates and health segments over time, forming the Churn Risk Curve.

- Highlight inflection points where customers transition from healthy to at-risk.

- Monitor these curves per segment to tailor intervention strategies.

- Automate Early Intervention Campaigns

The true power of your CRM lies in actionability. Once at-risk customers are identified:

- Trigger automated campaigns such as personalized emails, SMS, push notifications, or loyalty offers.

- Set timing based on churn risk windows identified in your curve (e.g., send a re-engagement email at 30 days of inactivity).

- Use A/B testing to optimize messaging and incentives.

- Measure Campaign Effectiveness & Refine Your Curve

Use your CRM to track:

- Response rates and conversion of retention campaigns.

- Changes in customer health scores post-intervention.

- Overall impact on retention and churn rates.

Regularly update and refine your Churn Risk Curve model using this feedback loop to improve prediction accuracy and campaign ROI.

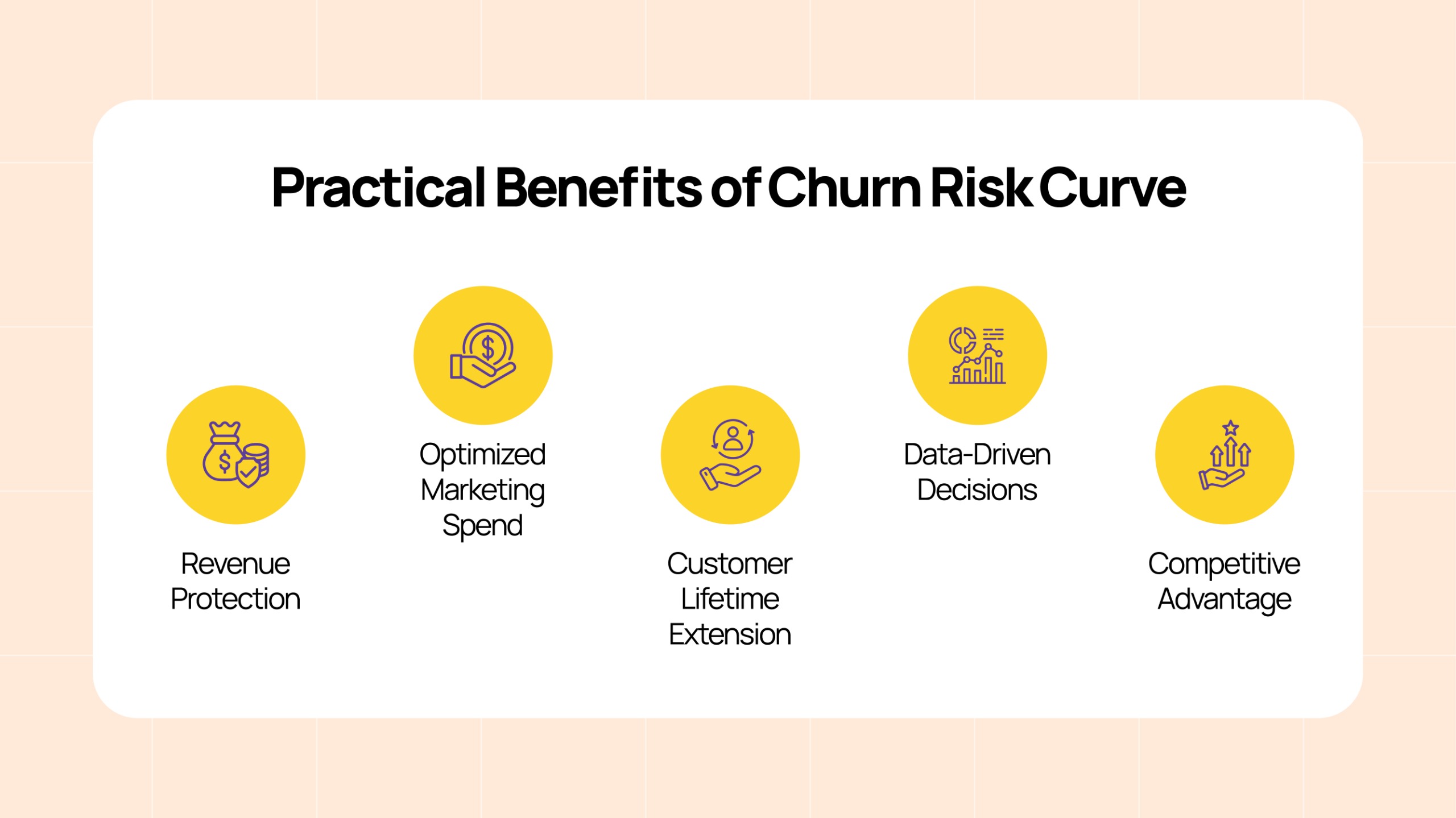

Practical Benefits of Churn Risk Curve

- Revenue Protection: By reducing churn, you safeguard steady cash flow from your most valuable customers.

- Optimized Marketing Spend: Targeting retention efforts precisely improves ROI compared to broad campaigns.

- Customer Lifetime Extension: Early actions increase the average lifespan of customers, boosting profitability.

- Data-Driven Decisions: The framework transforms raw data into clear insights, empowering leadership to act confidently.

- Competitive Advantage: Companies that proactively manage churn outperform peers who react only after losses occur.

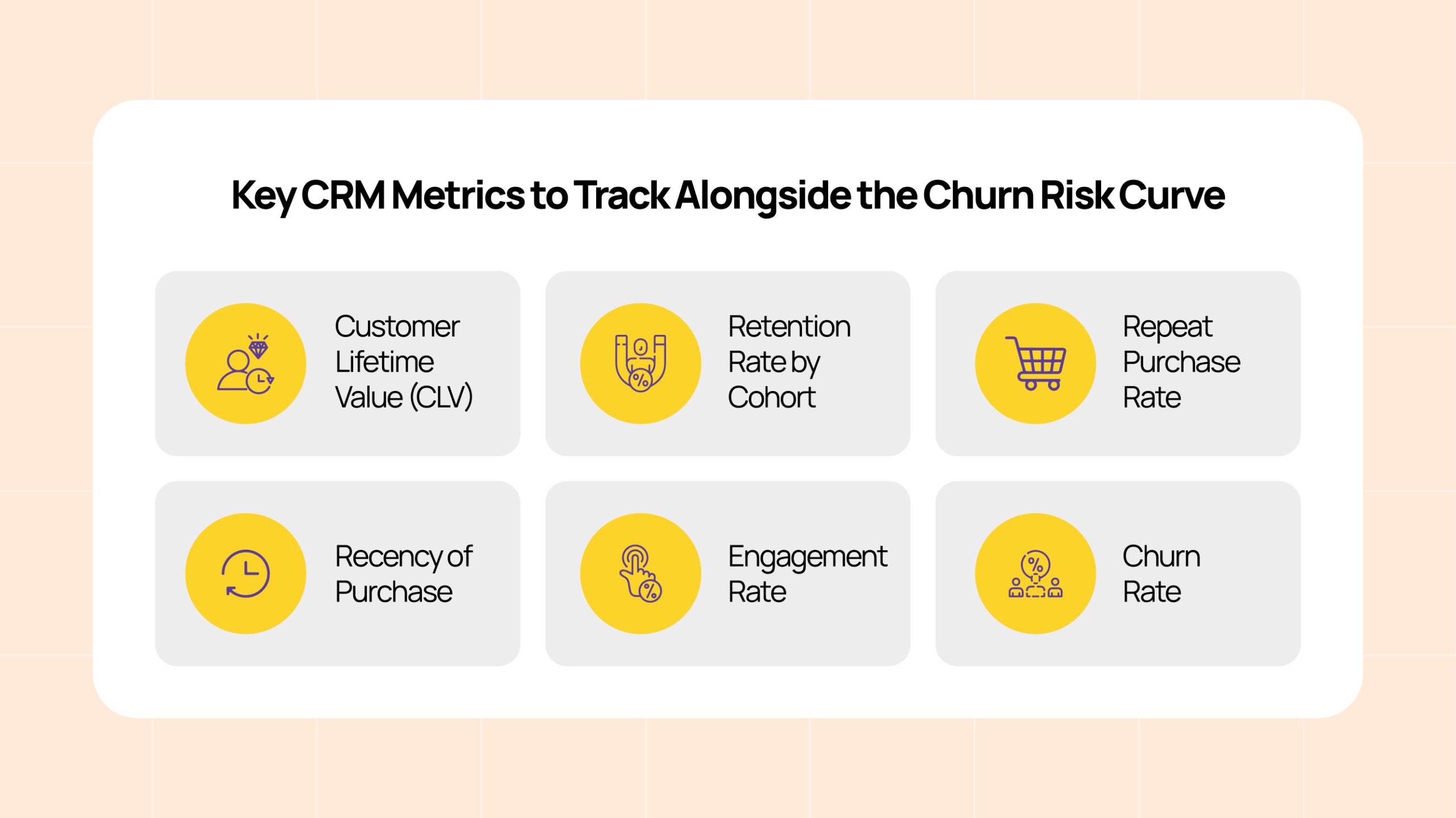

Key CRM Metrics to Track Alongside the Churn Risk Curve

To optimize retention efforts, monitor these critical metrics:

- Customer Lifetime Value (CLV): Projected revenue per customer over their lifespan.

- Retention Rate by Cohort: Percentage retained at specific time intervals.

- Repeat Purchase Rate: Frequency of repeat transactions.

- Recency of Purchase: Days since last transaction.

- Engagement Rate: Email opens, clicks, app or website usage.

- Churn Rate: Percentage of customers lost during a period.

Conclusion

The Churn Risk Curve is not a theoretical concept but a practical tool rooted in proven statistical models that can transform your CRM strategy. By combining Pareto insights with cohort retention analysis, you gain a dynamic view of customer health, enabling early and effective intervention.

In a retail landscape where customer acquisition costs continue to rise, with global average costs per new customer hitting more than $200+ in many sectors, focusing on retention with data-backed strategies is the sustainable path forward.

If your business hasn’t yet incorporated churn risk modeling in your CRM stack, now is the time. Early detection, combined with personalized engagement, will not only reduce churn but also foster loyalty and long-term growth.