Did you know 60% of SaaS startups fail because they neglect customer retention (Ptolemay, 2025)?

How much is each customer really worth to your business, and what’s it costing you to bring them in? This is a simple yet powerful question that is central to driving sustainable growth. Unfortunately, many businesses heavily focus on short-term metrics, like Customer Acquisition Cost (CAC), without fully considering the long-term value that Customer Lifetime Value (CLV) brings.

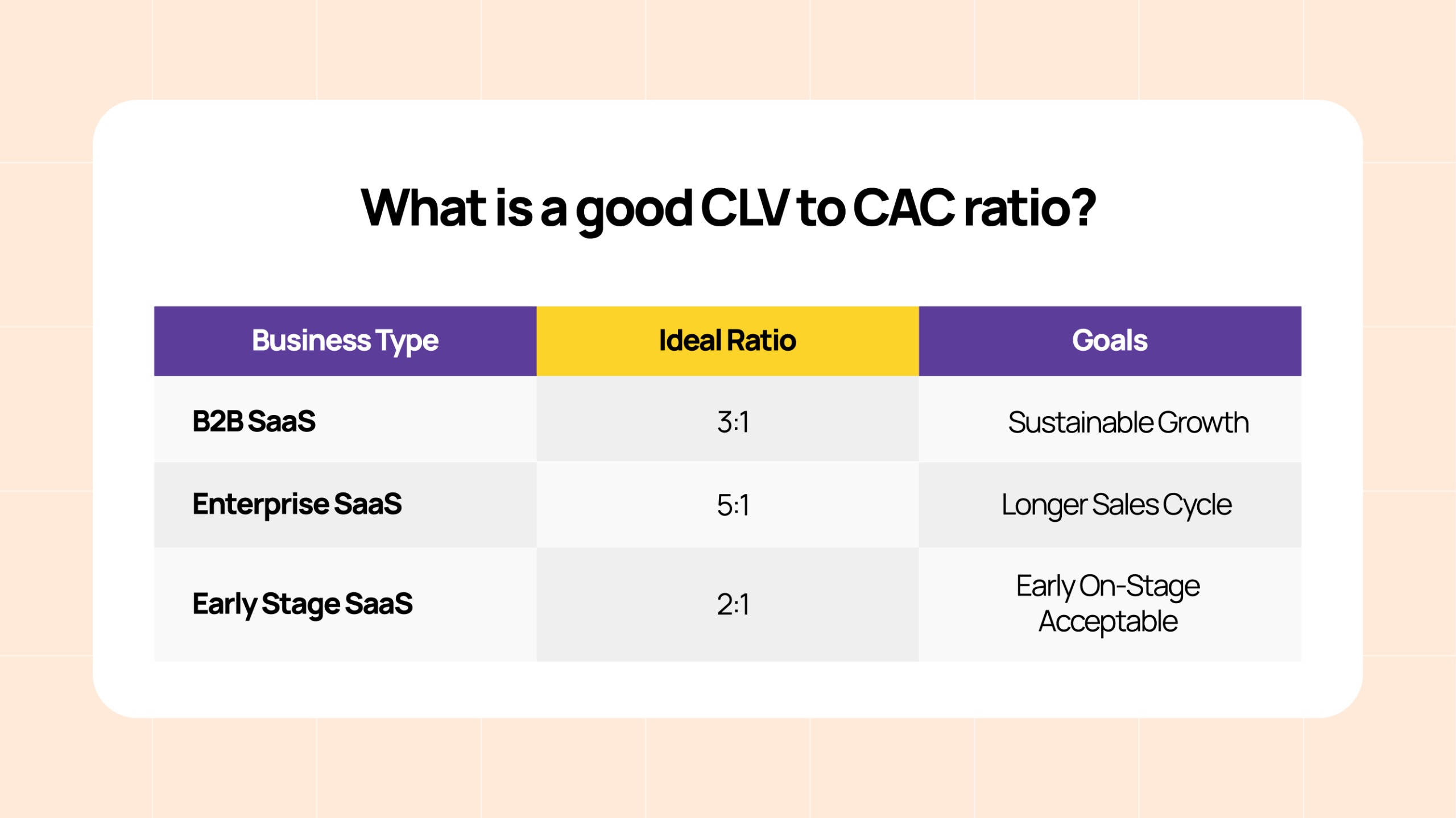

Here’s a stat that you should know: If your CLV: CAC is below 3:1, you’re losing money on every customer.

It’s easy to get caught up in the rush of acquiring new customers, but retaining them and maximizing their lifetime value is the key to building a thriving, profitable business. Let’s understand how.

What is CLV Vs. CAC Ratio?

If you are looking forward to understanding the health of your business, then CLV Vs. CAC ratio is one of the key metrics that you should consider. This is because this ratio measures how much value you are getting from your customers compared to the amount of money you are spending to acquire them.

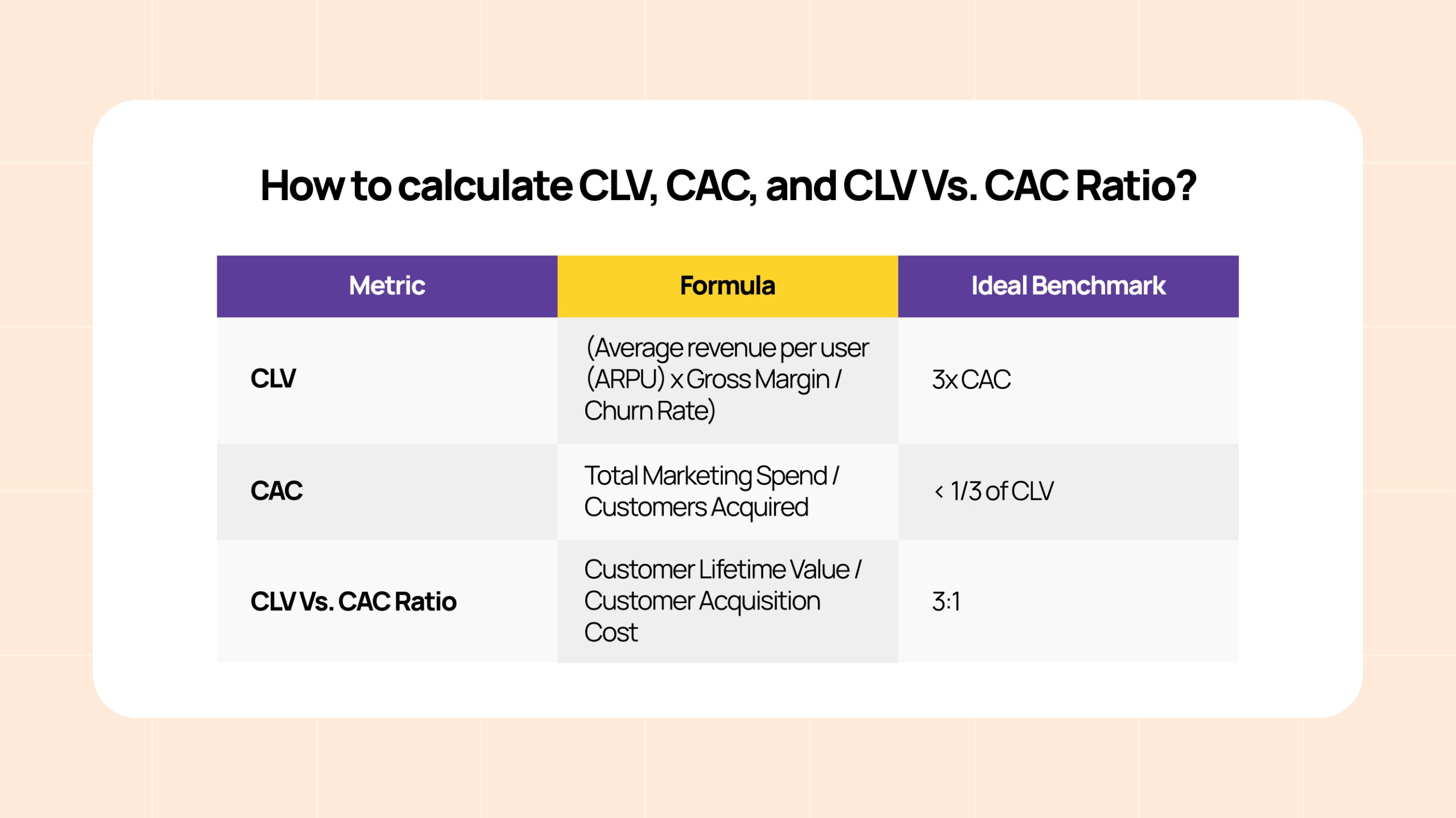

- CLV (Customer Lifetime Value) – This refers to the total revenue a customer is expected to bring to your business during their entire relationship with your brand.

- CAC (Customer Acquisition Cost) – It is the total cost of acquiring a new customer, including the marketing and sales effort.

Why does it matter?

If your CLV is greater than your CAC, it means you’re getting a positive return on your acquisition efforts, which is crucial for long-term sustainability, but if your CAC is higher than your CLV, it could indicate unsustainable customer acquisition practices, and your business will struggle to grow in the long run.

How CLV vs. CAC Ratio Impacts Your CRM Strategy?

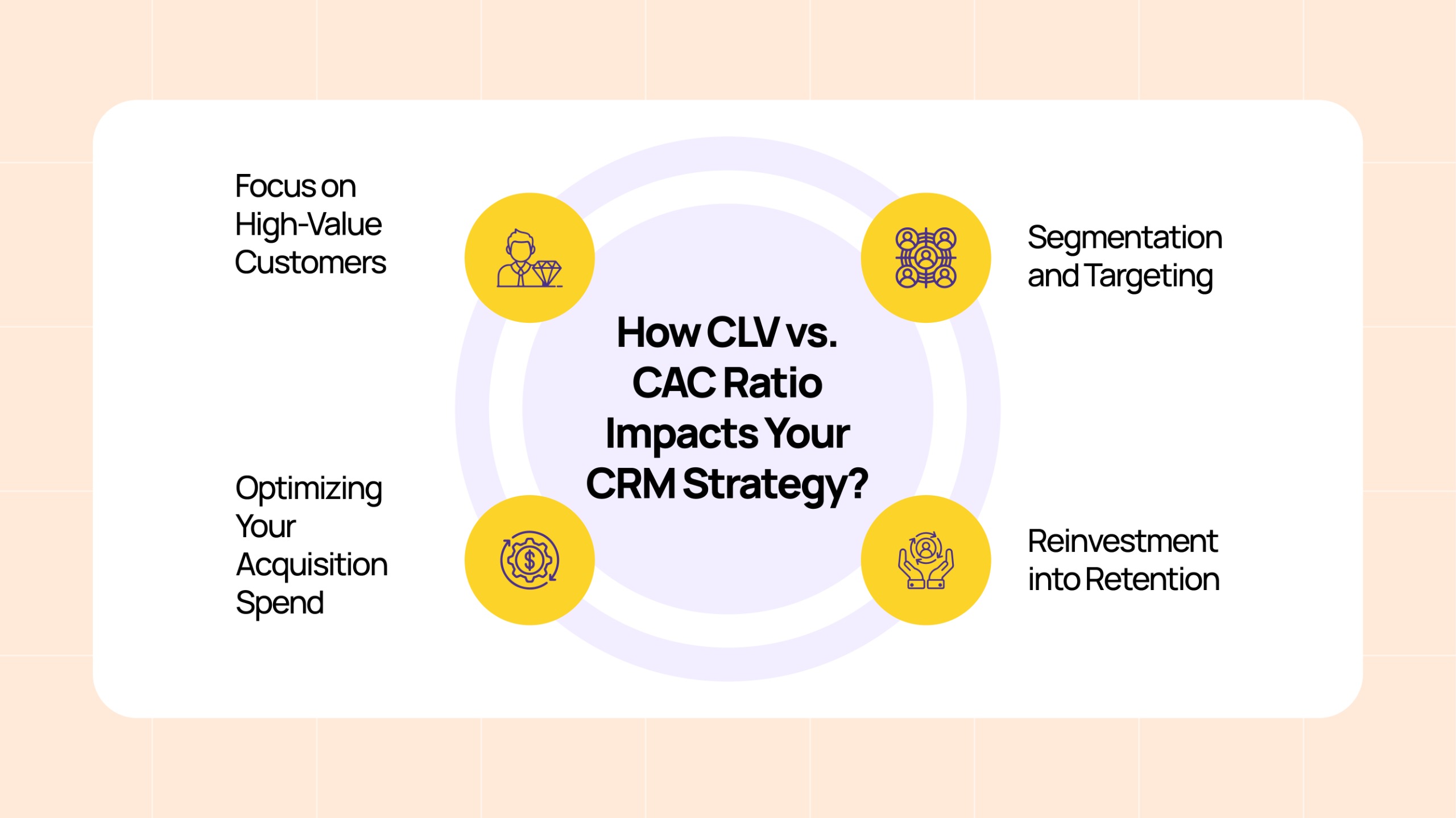

Understanding the CLV vs. CAC ratio directly influences how you plan and optimize your CRM strategy. Here’s why:

- Focus on High-Value Customers: If your CAC is higher than your CLV, your CRM strategy needs to focus on retention, engagement, and lifetime value. Using CRM data, you can identify which customers are most likely to convert and remain loyal and target them with personalized campaigns to maximize their value over time.

- Optimizing Your Acquisition Spend: When your CLV is greater than your CAC, it signals that your acquisition strategy is working. In this case, you can increase your marketing spend to acquire more customers, while also fine-tuning your CRM strategies to maximize the value of these new customers.

- Segmentation and Targeting: The CLV/CAC ratio helps you segment customers by their potential lifetime value, allowing you to tailor your CRM efforts based on their journey. For example, high-value customers can receive exclusive offers, while low-value customers might benefit from additional nurturing to increase their loyalty.

- Reinvestment into Retention: A healthy CLV/CAC ratio means that you’re retaining customers at a profitable rate, which enables you to reinvest those savings into retention-focused CRM activities, such as loyalty programs, referral rewards, or personalized experiences.

Why CLV vs. CAC Ratio Matters for Sustainable Acquisition?

Focusing solely on Customer Acquisition Cost (CAC) might yield quick wins, but CLV is the real long-term success metric. If you’re only acquiring customers at high costs but not retaining them, you’re essentially spending more to get less.

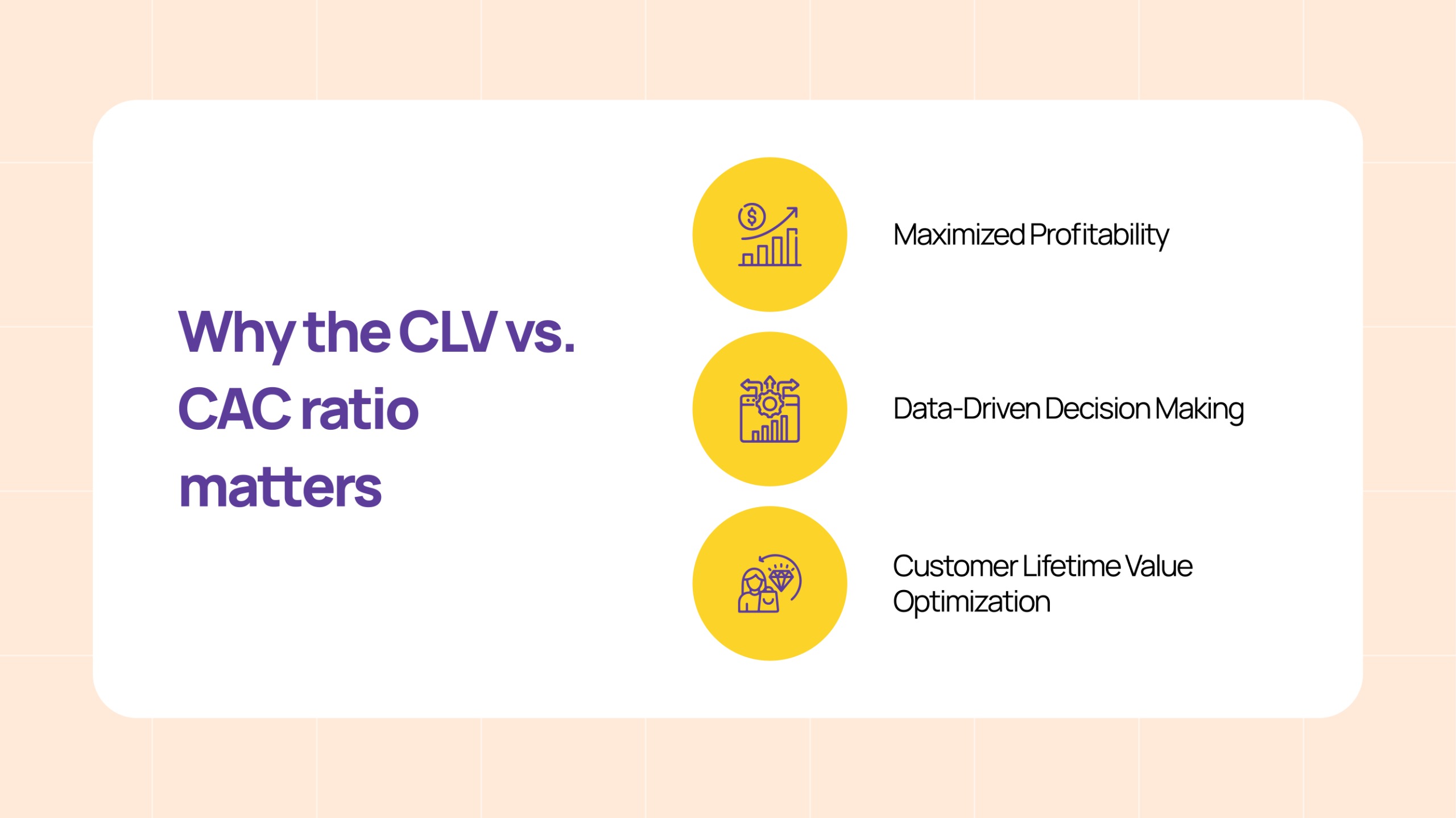

Here’s why the CLV vs. CAC ratio matters:

- Maximized Profitability: By ensuring your CLV exceeds your CAC, you ensure that every customer brings in more revenue over time than it costs to acquire them. This leads to better margins, healthier growth, and a stronger bottom line.

- Data-Driven Decision Making: Understanding how much you’re spending to acquire customers and how much revenue they generate over time allows for informed decision-making on where to focus your marketing budget and CRM efforts.

- Customer Lifetime Value Optimization: A higher CLV allows you to spend more on acquisition, thus enabling growth. CRM strategies that emphasize personalization, loyalty, and customer success can maximize CLV, ensuring you continue to derive value from customers long after the initial purchase.

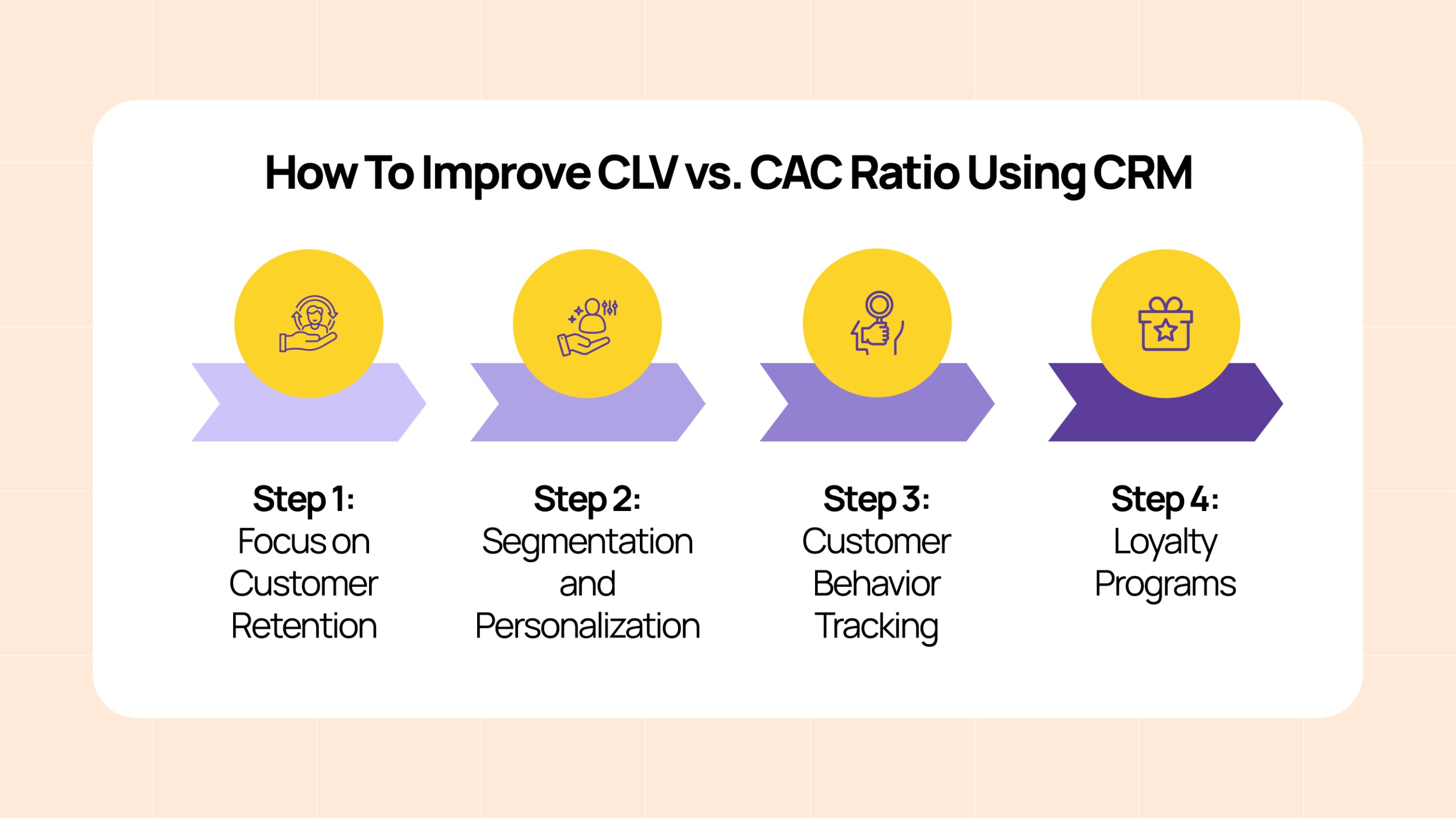

How To Improve CLV vs. CAC Ratio Using CRM

To leverage CRM systems effectively for optimizing your CLV/CAC ratio, here are some actionable steps:

- Focus on Customer Retention: CRM allows you to automate customer engagement through follow-up emails and personalized offers, making it easier to retain customers and improve their lifetime value. By keeping customers engaged, you’re ensuring their continued business, thus enhancing CLV.

- Segmentation and Personalization: With CRM tools, you can segment your customers based on purchasing behavior, demographics, or engagement history. Personalized communication tailored to these segments will increase the chances of repeat business and higher CLV.

- Customer Behavior Tracking: CRM can be used to track each customer’s journey, from the initial purchase to repeated transactions, and understand their lifetime value. This data helps in determining which marketing channels are most effective in reducing CAC and increasing CLV.

- Loyalty Programs: CRM tools can be used to set up loyalty programs that reward repeat customers. These programs reduce churn, increase engagement, and ultimately raise CLV.

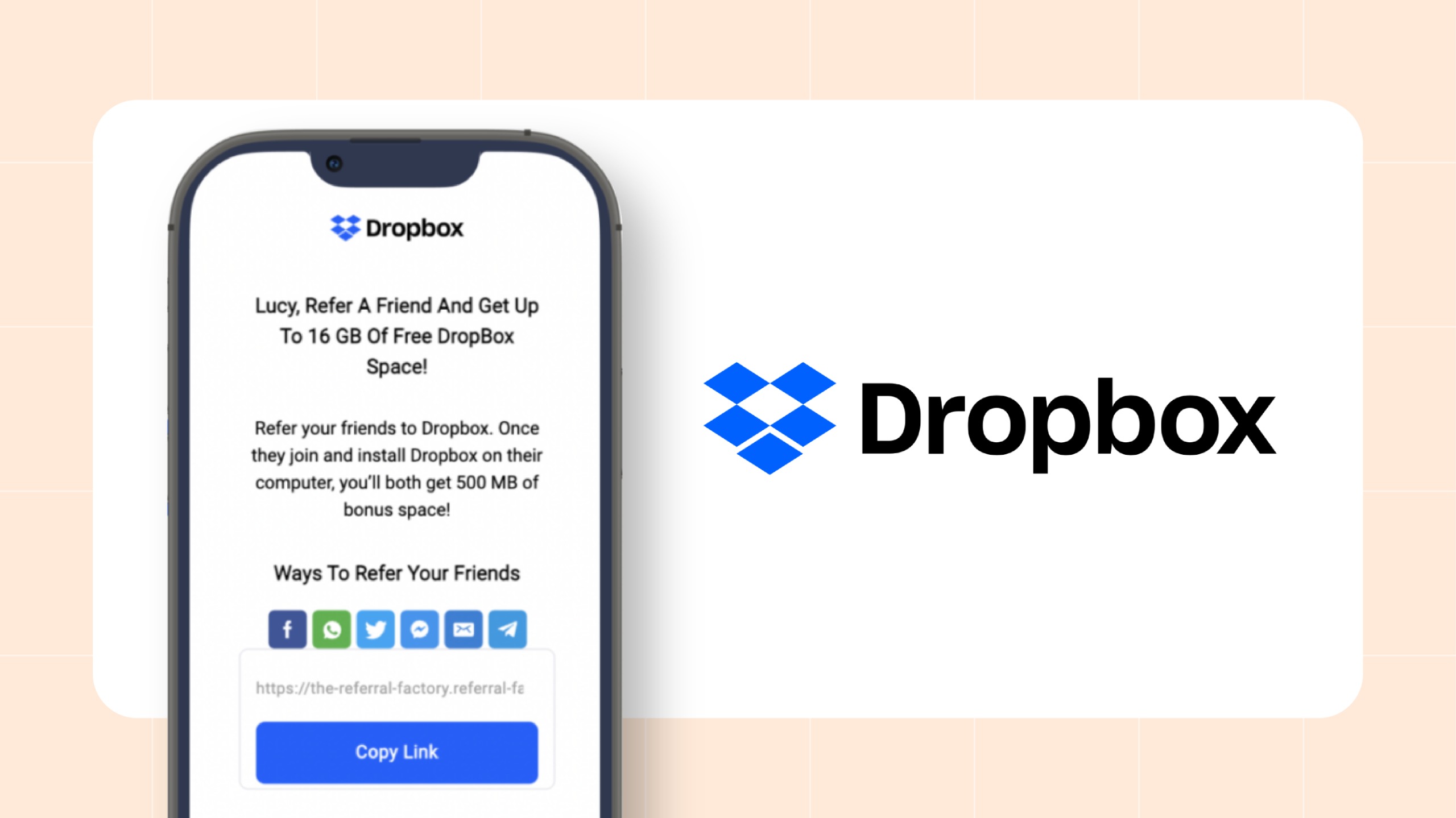

Dropbox’s Referral Program: A Powerful Boost to CLV vs. CAC Efficiency

Challenge:

Dropbox faced high Customer Acquisition Costs (CAC) and needed a cost-effective strategy to grow its user base while maintaining long-term customer value (CLV).

Solution:

They launched a refer-a-friend program, rewarding both the referrer and the referred with free storage. This turned existing customers into advocates, reducing the reliance on costly traditional marketing.

Results:

- 60% increase in customer acquisition through referrals.

- Lowered CAC by leveraging word-of-mouth marketing instead of paid ads.

- Higher CLV: Referred customers were 16% more likely to upgrade to paid plans, leading to greater long-term value.

- Improved retention rates, with referred users staying engaged longer.

Impact on CLV vs. CAC Ratio:

The referral program improved the CLV/CAC ratio from 2:1 to 5:1, indicating higher ROI and more sustainable growth.

Conclusion

The CLV vs. CAC ratio is a reflection of your ability to nurture valuable relationships and make every marketing penny count. Instead of chasing every lead, it’s about building strong, lasting connections that continue to deliver over time.

So, take a step back and think: Are you acquiring customers who’ll stick around and bring lasting value? If not, it’s time to adjust your strategy.Ready to make smarter, sustainable growth happen? Talk to us and fine-tune your CLV vs. CAC ratio to unlock the long-term success your business deserves.