For most retail enterprises, the Point of Sale (POS) is traditionally viewed as the finish line, the place where a transaction is completed and a receipt is handed over. However, in an era where data-driven personalization dictates market share, treating the POS as an endpoint is a strategic oversight. Every anonymous transaction is a missed opportunity to build a lifecycle. The challenge for large-scale retail is no longer just about processing payments; it is about effortless customer data capture at the POS without disrupting the store throughput.

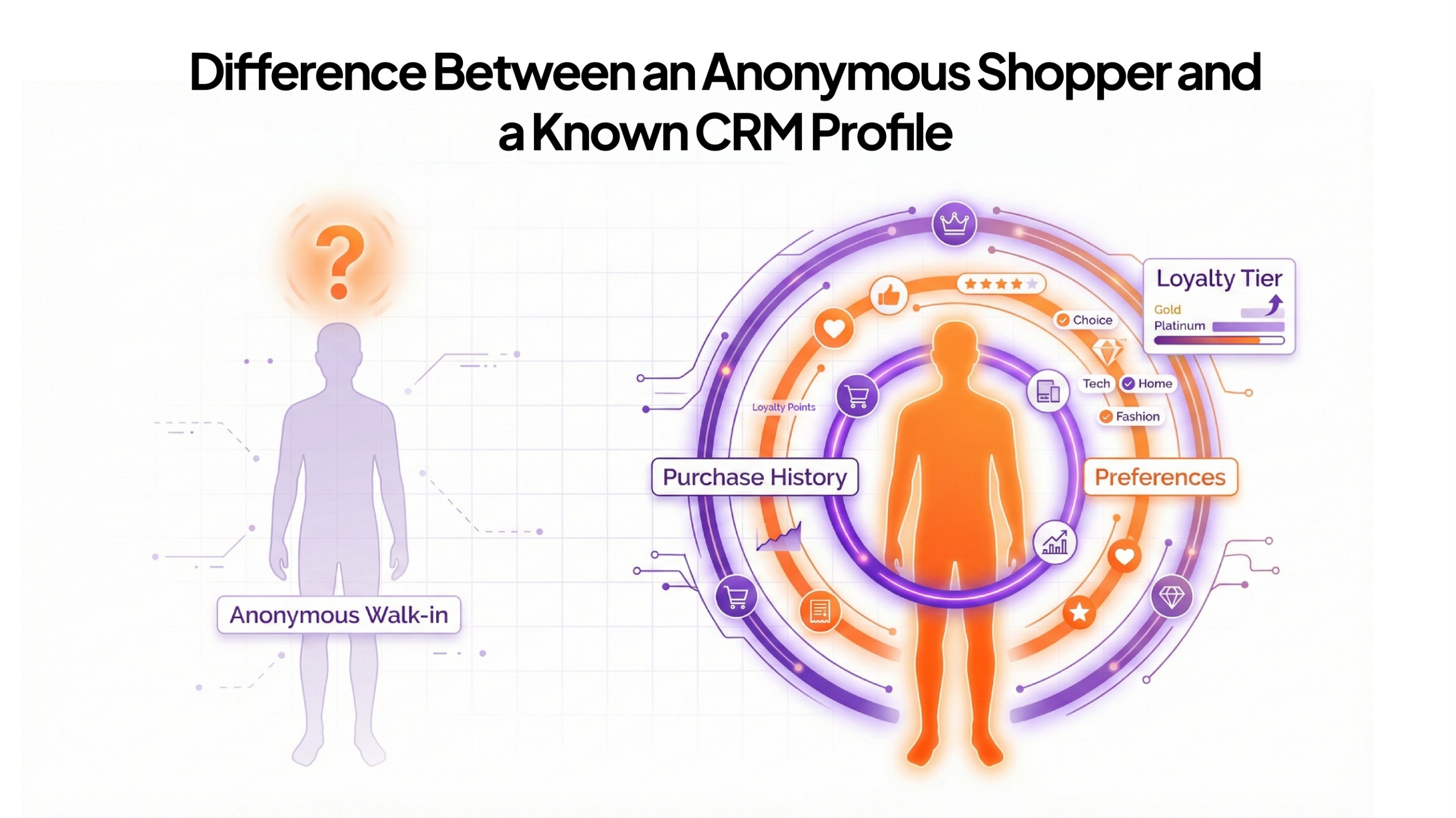

When a customer leaves your store without being identified, they become invisible to your CRM. You cannot retarget them, you cannot reward them, and you cannot predict their next move. To move beyond the bill, retail leaders must transform the checkout experience from a cold financial transaction into a gateway for long-term engagement.

In fact, retailers that leverage POS data effectively grow revenues up to 30% faster and reduce inventory costs by as much as 15%, all while enabling more personalized experiences that drive repeat purchase behavior.

The Reality of the ‘Anonymous’ Walk-in

In the high-velocity Indian retail landscape, especially during peak weekend rushes or festive shifts, the biggest friction point to data collection is time. If a CRM enrolment process takes more than 30 seconds, the store staff ignores it, and the customer resists it. This results in “data gaps” where a brand might see high sales volume but has zero visibility into who is actually buying.

At eWards, we believe that the POS must be an invisible data layer. Capturing a ‘known’ customer isn’t just about asking for a phone number; it’s about providing an immediate, tangible value exchange that justifies the disclosure of personal data. With our tool, your POS-CRM integration is always in real-time, ensuring that customers’ points, transactions, and preferences are instantly updated across all platforms, providing a seamless experience.

Why This Matters for Retail Enterprises

For an enterprise spanning 50 or 500 outlets, the difference between a 40% and an 80% capture rate is worth millions in retained revenue.

- Attribution Accuracy: You cannot measure the ROI of your digital spends if you cannot link an offline purchase to a digital identity.

- Reduced Dependency on Aggregators: By ensuring robust retail CRM enrolment at your own billing counters, you reduce the need to “rent” your customers back from third-party marketplaces or food/delivery aggregators.

- Hyper-Local Targeting: Known data allows you to trigger store-specific campaigns based on the inventory levels of a particular catchment area.

A Framework for Frictionless Capture

To transition from ‘billing’ to ‘engagement,’ enterprise teams should focus on these three pillars:

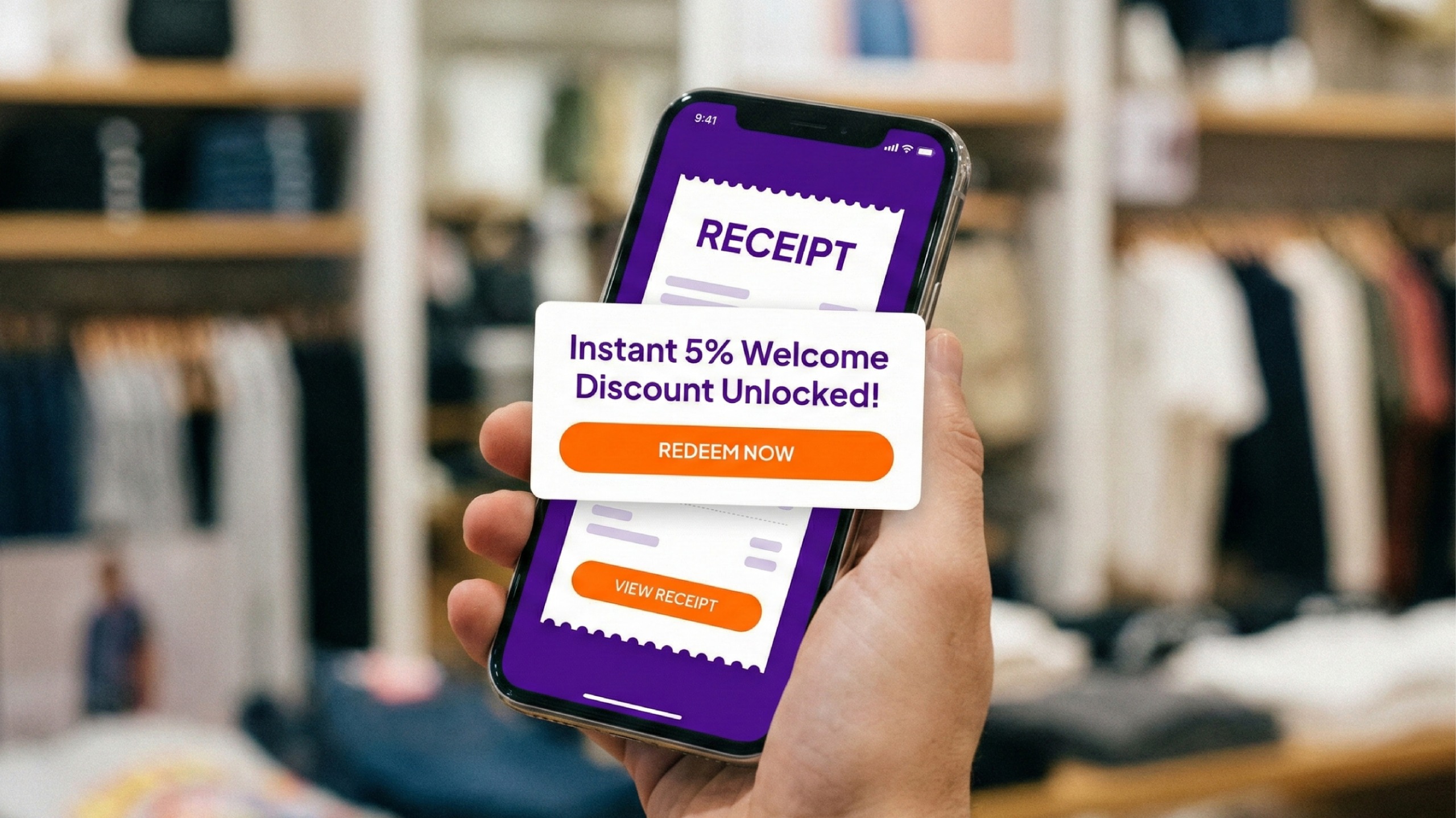

- The Digital Receipt as a Hook Paper: Receipts are frequently lost or discarded. By implementing digital receipt marketing, you solve two problems at once: you save on thermal paper costs and provide a non-intrusive reason to ask for a mobile number. The digital receipt shouldn’t just be a PDF; it should be dynamic, featuring the customer’s current loyalty points and personalized “next-best-buy” recommendations.

- Value-First Enrolment: “Sir, would you like to join our loyalty program?” is a weak pitch. “Sir, may I apply your instant 5% welcome discount on this bill?” is an irresistible one. For enterprise CRM success, the enrollment must be tied to an immediate gratification trigger. Whether it’s an instant point credit or an unlocked “member-only” price, the value must be realized at the moment of the bill.

Common Pitfalls to Avoid

- Over-asking: Don’t ask for name, DOB, anniversary, and email at the billing counter. Capture the primary identifier (Mobile/WhatsApp) first. Use post-purchase triggers to “enrich” the profile later.

- Broken Sync: There is nothing more damaging to CX than a customer sharing their number, only for the system to fail to recognize their existing points. Your POS-CRM integration must be real-time.

The Takeaway:

Capturing known customers at the POS is the foundation of the entire CRM pyramid. Without high-quality, high-volume data capture, your segmentation and AI-led campaigns will lack the fuel they need to perform. As we move into the new financial year, the mandate for retail teams is clear: Audit your checkout friction. Switch to digital-first identification. Make every bill a bridge to the next visit.

Subscribe for Smarter, Data-Driven CRM Insights

Ready to elevate your CRM strategy with smarter testing? Subscribe to our newsletter for expert insights on AI-driven CRM optimization for improved customer engagement and ROI.