As the 2025-26 financial comes to an end next month, retail CXOs and CRM managers are facing a familiar, frustrating reality: the numbers on their POS reports don’t align with their CRM dashboards.

While the POS might show record-breaking transaction volumes from the recent festive and wedding seasons, the CRM often tells a different story, missing customer profiles, duplicated identities, or “ghost” transactions that lack attribution. These issues don’t just mess up reports but also cause missed opportunities in marketing automation.

When your billing engine and your engagement engine speak different languages, the result is lost revenue, inaccurate LTV (Lifetime Value) calculations, and a strategic blind spot that hampers your 2026-27 planning.

Core Insight: The “Sync Gap” in Modern Retail

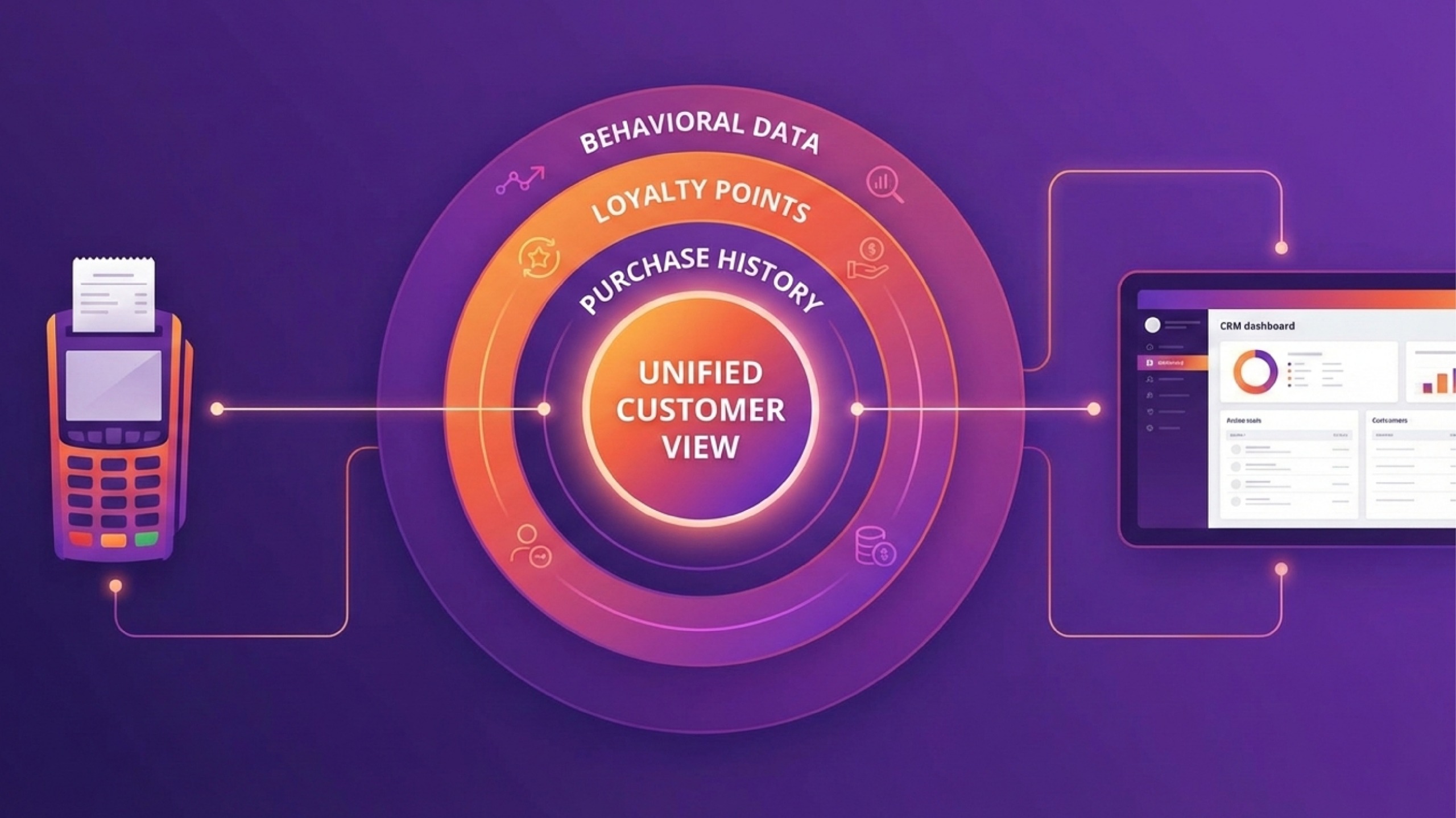

The discrepancy between POS and CRM typically stems from a “sync gap”, i.e., the delay or failure in translating a raw transaction into a verified customer milestone. Think about it as a jumbled puzzle where every piece must fit perfectly to create the whole picture.

In many enterprise retail setups, the POS is treated as a system of record (focused on inventory and tax compliance), while the CRM is treated as a system of customer engagement.

When these systems operate in isolatedly, a customer might be identified by a phone number at the counter, but if the API fails to sync that data in real-time, or if the POS allows “guest checkouts” without pushing that data to the CRM, the audit trail breaks.

In 2026, where omnichannel journeys are the norm, a customer might buy online and return in-store; if your data reconciliation isn’t automated, the entire system breaks down

Why This Matters for Retail Enterprises

In the Indian context, this complexity is amplified by the sheer volume of transactions and the diversity of payment methods. During the rapid sale periods, many POS systems prioritize billing speed over data capture quality to manage floor crowds. However, as we approach the financial year end retail audits, this “speed-first” approach backfires.

Regulatory compliance (such as India’s DPDP Act) requires accuracy, traceability, and lawful handling of customer personal data across systems. If you cannot reconcile who bought what and where, you risk not only marketing inefficien cy but also compliance failures. More importantly, without accurate retail data reconciliation, your loyalty program ROI becomes impossible to defend. You cannot reward behavior that you cannot accurately track.

Common Causes of POS CRM Discrepancy

1) The API Lag: Traditional batch-processing where data syncs once every 24 hours. By the time the CRM receives the data, the customer has already left the store and missed the “Thank You” trigger.

2) Duplicate Identity Proliferation: A single customer appearing as three different entities because they used a different mobile number or email at different touchpoints, and the system lacked a deduplication logic during the sync.

3) Offline-to-Online Mismatch: Returns and exchanges handled at the POS often fail to reflect in the CRM’s “Total Spend” or “Tier Status,” leading to customers being over-rewarded or under-served.

The eWards Approach: Moving Toward “Zero-Latency” Reconciliation

To solve the audit crisis, retail teams must move away from manual end-of-month reconciliations toward an automated, event-driven architecture.

- Real-time Webhooks: Ensure every invoice generated at the POS triggers an immediate update in the CRM.

- Unified Customer ID: Implementing a “Golden Record” strategy where the POS validates the customer against the CRM database before the bill is finalized.

- Audit-Ready Dashboards: Instead of cleaning data in April, we recommend a weekly “Data Health Scorecard” to identify and fix sync errors as they happen.

Conclusion: Preparing for the 2026-27 Cycle

The end-of-year audit shouldn’t be a post-mortem of what went wrong; it should be a baseline for what comes next. Solving CRM POS data integration issues is the first step in transitioning from a reactive marketing team to a data-led retail strategy. As you close your books this March, remember: your CRM is only as powerful as the POS data that feeds it. Clean data today is the foundation for hyper-personalized engagement tomorrow.

Subscribe for Smarter, Data-Driven CRM Insights

Ready to elevate your CRM strategy with smarter testing? Subscribe to our newsletter for expert insights on AI-driven CRM optimization for improved customer engagement and ROI.