Loyalty program fraud in retail and F&B can result in financial losses, wasted marketing budgets, and diminished customer trust. Using fraud detection systems for real-time monitoring, automated alerts, and comprehensive analytics can prevent fraud, protect your loyalty program, and restore customer confidence.

In the fast-paced world of retail and F&B, loyalty programs are a cornerstone of customer engagement and retention. But what happens when those very programs are exploited by fraud?

Whether it’s fake accounts, unauthorized credit issuance, or employees exploiting loopholes, fraud can undermine even the most well-designed programs. And the worst part? Many businesses don’t even realize they’re losing money until it’s too late.

It erodes the integrity of your brand, reduces customer trust, and drains your marketing budget. But with the right loyalty program fraud detection measures in place, you can safeguard your investments and keep your program running smoothly.

Why Is Loyalty Program Fraud a Bigger Problem Than You Think?

While it may seem like a small issue, loyalty fraud can have far-reaching consequences:

- Financial Losses: Fraudulent activities, like issuing credits to fake accounts or manipulating reward systems, can lead to significant financial drain.

- Wasted Marketing Budgets: Resources allocated to target loyal customers are squandered when fraud distorts the effectiveness of campaigns.

- Erosion of Trust: Customers lose trust in a loyalty program that rewards fake accounts or incorrectly issued credits, ultimately damaging brand loyalty.

- Operational Inefficiency: Manual checks and audits, when fraud goes unchecked, become an unnecessary burden on resources.

In fact, fraud undermines the entire framework of customer engagement and trust that loyalty programs are built upon.

How eWards’ Fraud Detection Modules Can Protect Your Investment

The key to combating loyalty fraud is a robust fraud detection system integrated directly into your CRM. eWards’ fraud detection module is designed to identify discrepancies in real-time. These systems track every transaction, flagging suspicious behavior such as multiple credits issued to the same mobile number in a short period of time, or transactions that violate your set limits.

Key features include:

- Automated Fraud Detection: The fraud detection module flags transactions that exceed preset thresholds or violate business rules.

- Real-Time Alerts: Businesses are notified instantly when fraud is detected, allowing for swift corrective action.

- Comprehensive Analytics: The system offers deep insights into transaction patterns, helping you spot fraud trends early.

With this tool, businesses can safeguard the integrity of their loyalty programs while reducing the need for manual monitoring.

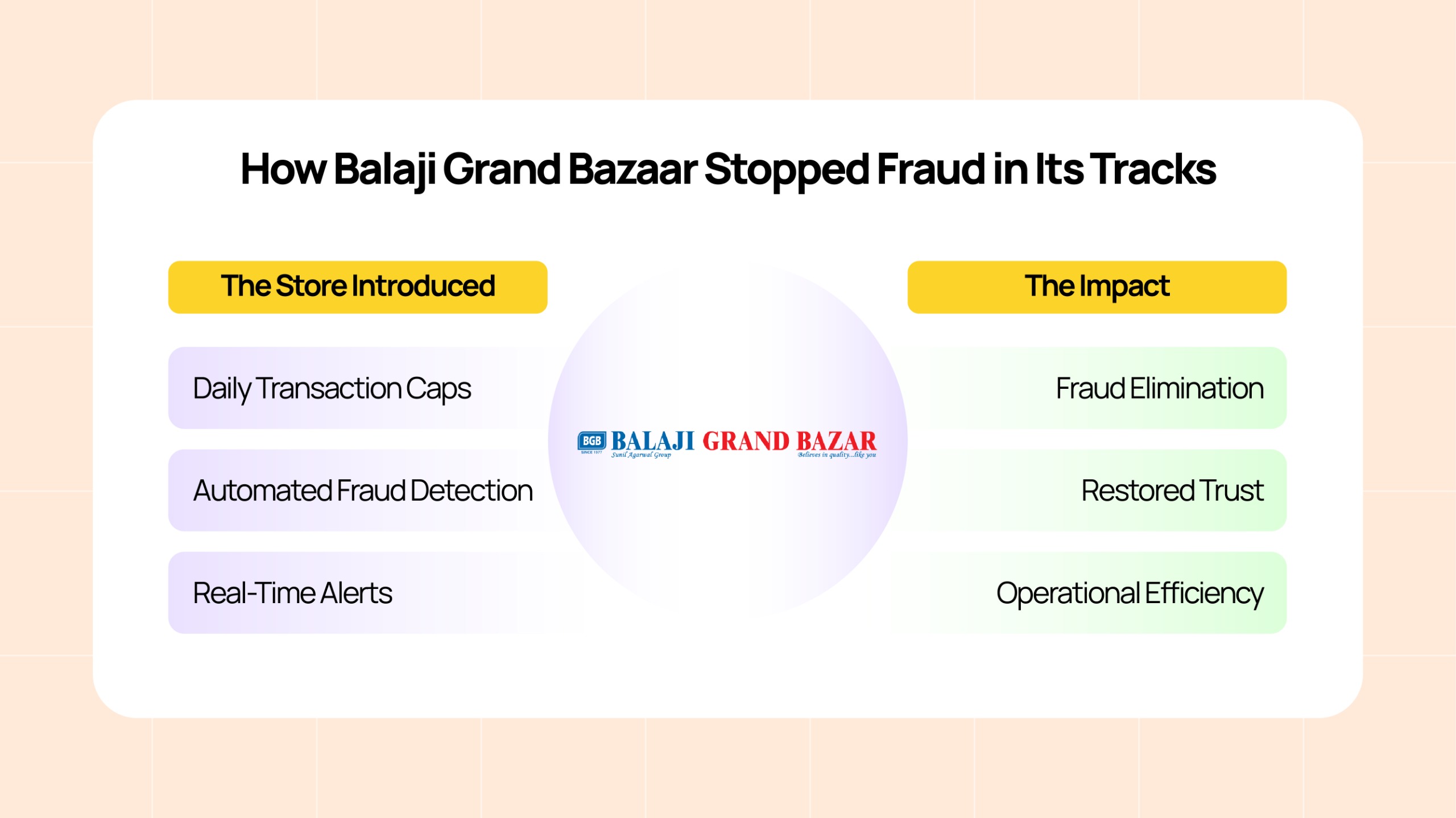

How Balaji Grand Bazaar Stopped Fraud in Its Tracks

Balaji Grand Bazaar, a well-known retail chain in India, faced a critical issue with loyalty fraud. Cashiers were exploiting the system by issuing loyalty credits to their personal mobile numbers across multiple transactions each day. This fraudulent activity not only resulted in financial losses but also eroded customer trust in the program.

By implementing eWards’ Fraud Module, the store introduced:

- Daily Transaction Caps: Limiting the number of credits issued to one transaction per mobile number per day.

- Automated Fraud Detection: The system automatically blocked transactions that exceeded this threshold.

- Real-Time Alerts: Immediate notifications were sent when fraudulent behavior was detected, allowing for quick action.

The impact was outstanding:

- Fraud Elimination: The fraud detection system blocked unauthorized transactions, saving significant amounts of money.

- Restored Trust: Customers regained confidence in the loyalty program, knowing that rewards were distributed fairly.

- Operational Efficiency: The system streamlined processes, eliminating the need for manual oversight and complex audits.

Balaji Grand Bazaar is just one example of how a robust fraud detection system can protect the integrity of your loyalty program, save money, and boost customer trust.

How to Implement Fraud Prevention in Your Loyalty Program?

If you’re serious about protecting your loyalty program, here’s how to implement fraud detection:

- Assess Your Current Program: Identify weak points where fraud may occur. Look for patterns in customer behavior that might indicate misuse.

- Integrate a Fraud Detection System: Choose a CRM with built-in fraud detection tools, like eWards, that will automatically monitor and block suspicious transactions.

- Set Clear Business Rules: Establish thresholds for transaction frequency, reward issuance, and customer behavior.

- Monitor and Audit: Regularly review transaction data to ensure that fraud is being caught before it escalates.

- React Quickly: Ensure that your fraud detection system alerts you in real-time, so you can take corrective action immediately.

By following these steps, you can build a resilient loyalty program that drives genuine customer engagement while safeguarding against fraud.

Ready to Secure Your Loyalty Program?

Loyalty fraud is a real and growing threat. Don’t wait until it impacts your bottom line. Protect your loyalty program with fraud detection systems, and start reaping the rewards of a secure, trusted system.

To read more such articles, subscribe to our eLab Newsletter.

FAQs

Loyalty fraud involves activities like fake accounts or unauthorized credit issuance that can lead to financial losses, wasted marketing resources, and a loss of customer trust, ultimately undermining the effectiveness of loyalty programs.

eWards’ fraud detection module flags suspicious transactions, provides real-time alerts, and offers in-depth analytics to identify fraud trends, helping businesses take swift corrective actions and protect their loyalty programs.

Businesses should assess their current program for vulnerabilities, integrate fraud detection tools, set clear business rules, regularly audit transactions, and ensure the system alerts them in real-time for immediate corrective action.