Higher AOV isn’t always better than higher frequency. The debate of AOV vs Frequency is one that many retail and F&B businesses face when optimizing retention but struggle to figure out which lever reduces CAC (Customer Acquisition Cost) faster for their specific business model.

For example, a cafe runs 20% off campaigns to bring customers back, but profits disappear. A fashion brand increases AOV with bundles, but customers still only buy once. Both are investing in retention but without a clear framework to decide between increasing order value versus increasing purchase frequency.

If you’re spending on acquisition and wondering whether to focus on increasing Average Order Value (AOV) or increasing purchase frequency, this framework will give you the answer based on your margins, repeat potential, and current retention performance.

The Short Answer

AOV reduces CAC faster when you have low repeat rates, long repurchase cycles, or strong upsell potential at checkout (bundles, add-ons, premium variants).

Frequency reduces CAC faster when you have a repeat-friendly category, strong retention channels (WhatsApp/SMS/email), and customers naturally come back, earning more without buying the customer again.

What “Reducing CAC” Actually Means in Retention Terms

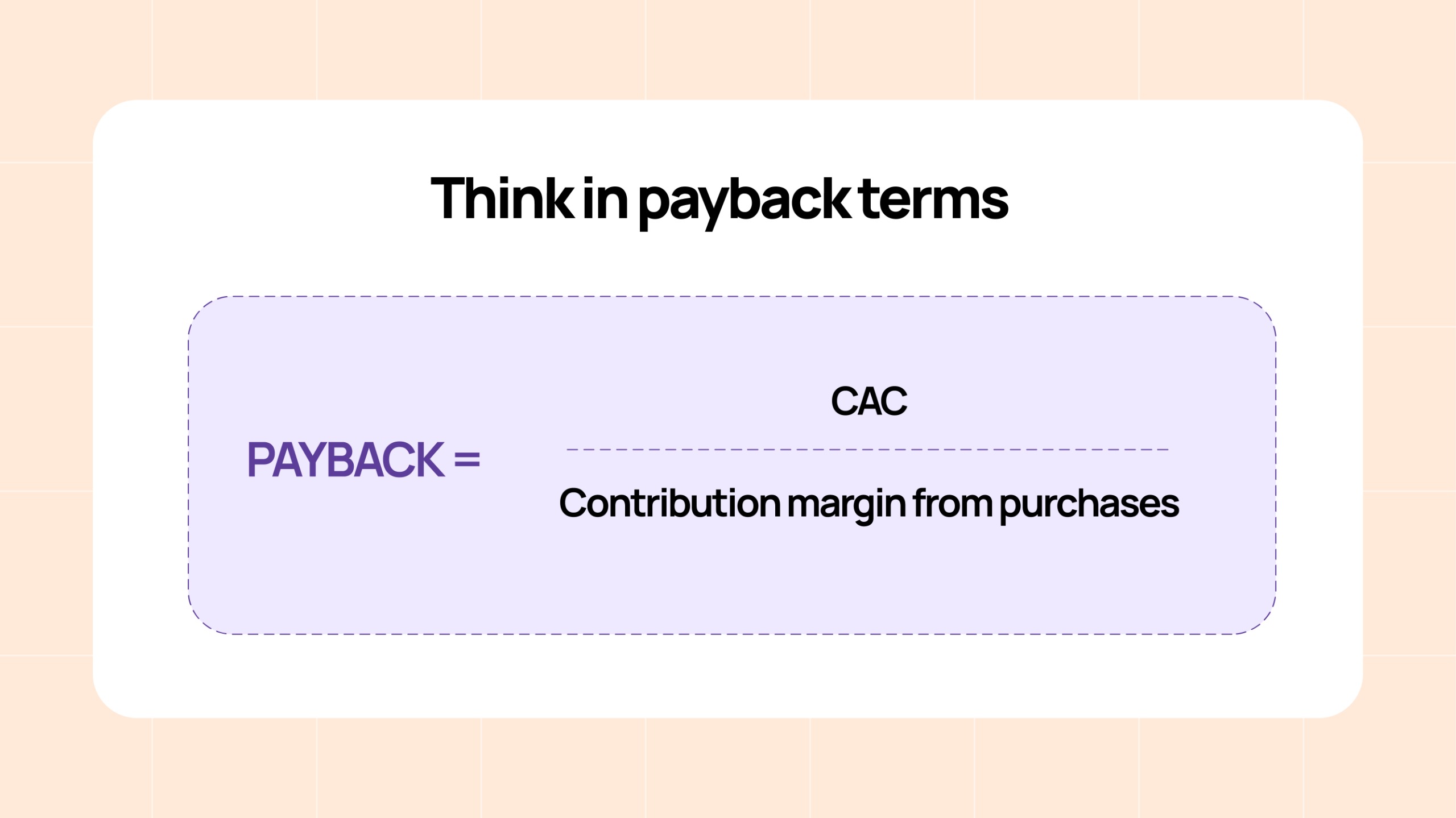

Most people treat CAC like a fixed number. It isn’t. CAC becomes “cheaper” when your customer generates more margin over time because your acquisition cost is spread across multiple purchases.

You reduce payback by increasing:

- Order margin (often via AOV), or

- Number of orders (frequency)

So AOV and frequency both reduce CAC, but they do it differently.

AOV vs Frequency: How Each Lever Works

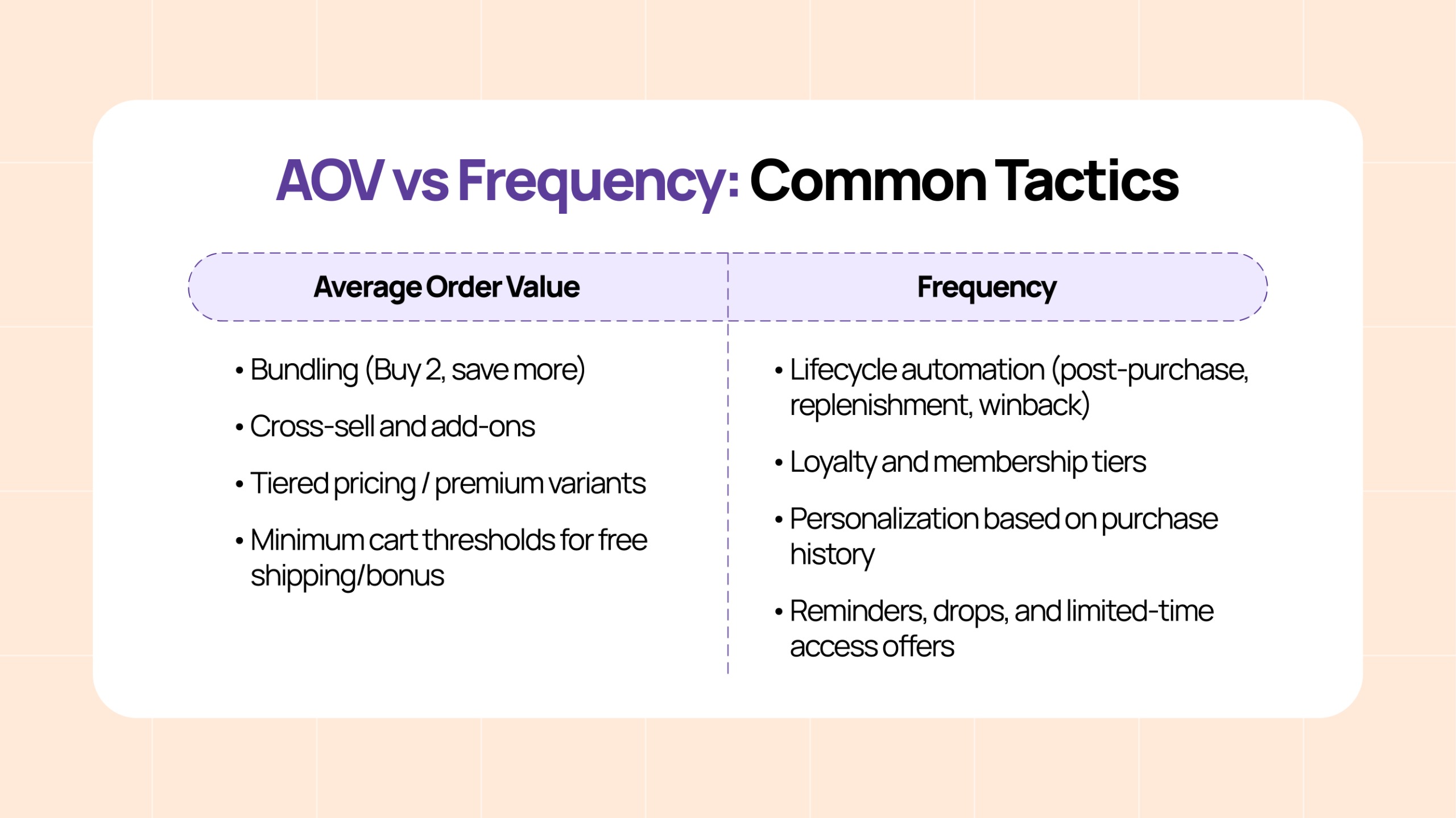

AOV (Average Order Value) – Increasing Revenue per Transaction

AOV helps by:

- Increasing revenue (and often margin) per transaction

- Improving first-order profitability and short-term payback

- Making each conversion “worth more”

Frequency – Increasing the Number of Purchases

Frequency helps by:

- Increasing the number of times a customer buys

- Raising LTV (lifetime value) and reducing blended CAC over time

- Compounding results as your customer base grows

Reminders, drops, and limited-time access offers.

Why This Framework Requires CRM Infrastructure

Here’s the reality: You can’t execute this framework in spreadsheets or with manual campaigns. Deciding between AOV and frequency requires real-time visibility into repeat rates, cohort behavior, and margin per segment. Executing it requires automated journeys triggered by customer actions, not manual campaign launches every week.

The brands winning at retention use CRM to:

- Identify which lever to pull based on actual customer data, not guesswork

- Automate the tactics without adding headcount or burning out your team

- Measure what’s working by cohort, not just overall revenue that masks what’s really happening

Without this infrastructure, you’re either optimizing blindly or spending all your time on manual execution instead of strategy.

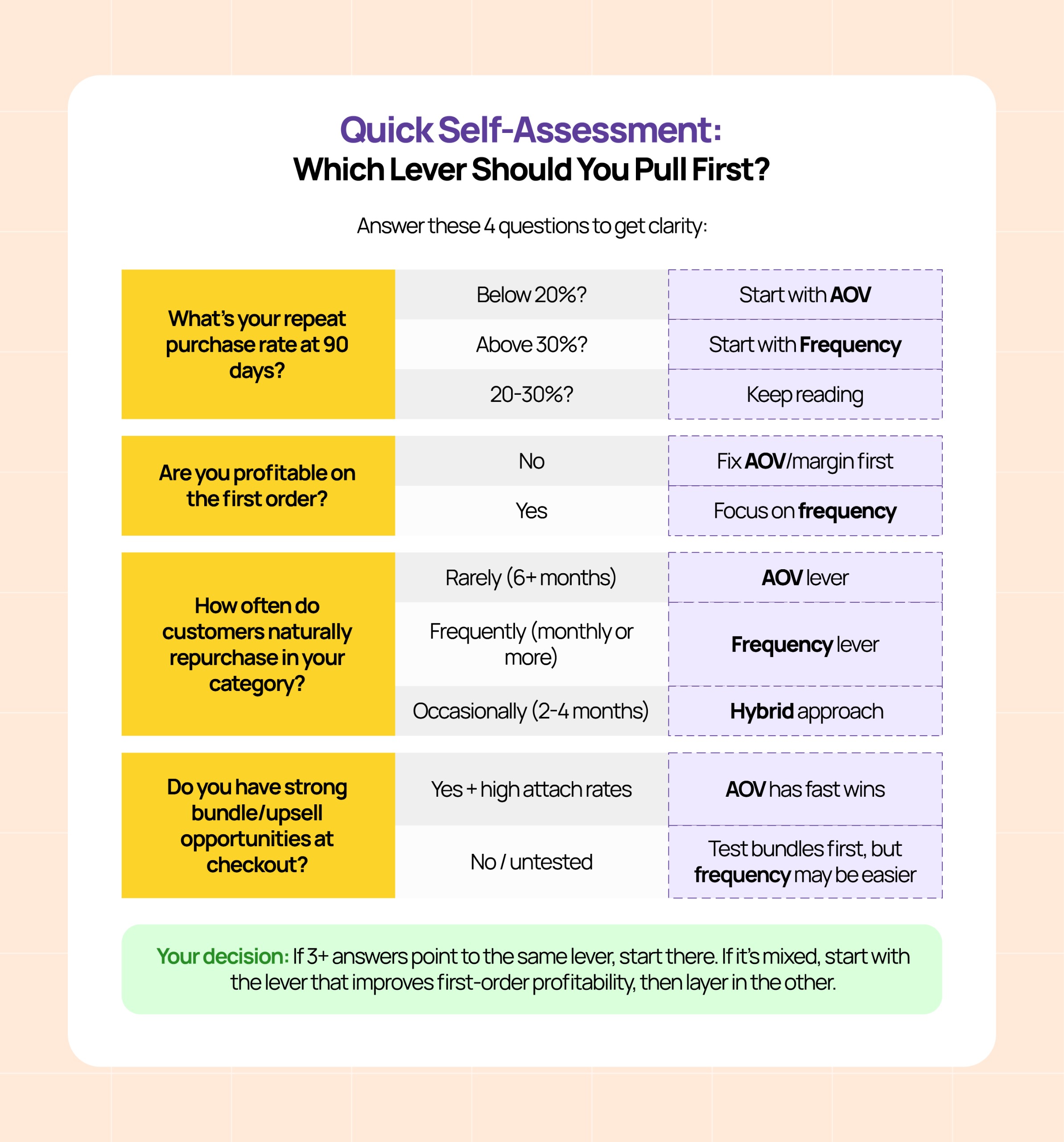

The Decision Framework: Which Reduces CAC Faster for You?

Choose AOV First When:

1. Your repeat cycle is long or uncertain

If your category isn’t naturally repeat-driven (or repeat happens after many months), frequency will take too long to influence CAC payback.

Examples:

- Furniture, mattresses, high-ticket electronics

- Occasion-driven luxury purchases

- Categories with low natural repurchase rates

2. Your first purchase is unprofitable (or barely breaks even)

If your CAC is high and first-order contribution margin is low, improving AOV can reduce payback immediately.

Examples:

- You spend ₹400 CAC

- Your contribution margin per order is ₹250

- You’re still ₹150 negative on the first order

3. You have strong “in-cart” upsell opportunities

Some categories are perfect for bundling and attach rates:

- Skincare: cleanser + serum + sunscreen

- Apparel: kurti + dupatta + accessories

- Footwear: shoes + socks + care kit

- F&B: meal combo upgrades, add a dessert/beverage

If you can lift AOV by 15-30% without heavy discounting, AOV is a fast CAC lever.

Choose Frequency First When:

1. Your category is naturally repeat-friendly

Frequency wins when customers have a reason to come back regularly:

- Fashion retail (seasonal drops, wardrobe refresh)

- Beauty and personal care (replenishment + experimentation)

- QSR/F&B (habit + convenience)

- Kidswear (growth cycles every 6-9 months)

- Grocery, essentials, wellness

In repeat categories, frequency is the lever that reduces blended CAC fastest over time because each additional purchase costs you almost nothing to generate compared to acquisition.

2. You already have a customer base you can re-engage cheaply

If you can reach customers via WhatsApp, SMS, email, or app push, frequency becomes a low-cost growth channel.

Why it matters:

- Acquisition costs scale up as competition rises (more brands bidding on the same audiences)

- Retention costs usually scale down with automation (one journey can run for thousands of customers)

If your CRM can trigger journeys automatically based on customer behavior, you can generate repeat orders at a fraction of acquisition spend often ₹20-50 per order vs ₹300-500 for new customer acquisition.

3. Your margins improve with repeat behavior

Repeat customers often:

- Need less discounting (they already trust you)

- Buy higher-margin SKUs (more confident to try premium products)

- Have higher trust and lower returns

So frequency doesn’t just add orders, it often adds better orders with healthier unit economics.

Practical Examples: AOV vs Frequency in Real Scenarios

Example 1: Fashion Brand with High Traffic, Low Repeat

- AOV: ₹1,800

- Repeat Rate: 18% at 90 days

- CAC: ₹450

What they did:

- Pushed bundles (2 kurtis at better price) → lifted AOV to ₹2,400

- Added ₹2,500 cart threshold for free shipping → 22% of orders hit the threshold

- Upsold premium fabric collections at checkout → 12% attach rate

Result: Payback dropped to 4 months on improved margin per order.

Later, frequency tactics: Set up seasonal drop alerts (WhatsApp) + 75-day winback automation → repeat rate climbed to 28%.

Key insight: AOV fixed immediate profitability. Frequency became the long-term lever once unit economics were healthy.

Example 2: Café/QSR with Decent Repeat Potential

- AOV: ₹350

- Customers can return weekly (high natural frequency potential)

- CAC from ads is rising (₹400+)

What they did:

- “Next visit” bounceback offer (₹100 off) → 31% redemption rate

- Membership perks (₹999/year) → Free add-on monthly

- Lapsed winback automation (Day 14 and Day 21) → SMS + WhatsApp

Result: Repeat customers now generate 60% of monthly revenue. Average customer makes 4.2 purchases in the first 90 days vs 1.8 before.

Key insight: Frequency compounded quickly with category support and cheap re-engagement channels.

Example 3: Beauty Brand with Replenishment + Cross-sell Potential

- AOV: ₹999

- Repeat potential is high (skincare routines = natural replenishment)

- Upsell opportunities also exist (serums, treatments, tools)

What they did first (Frequency):

- Replenishment reminders based on product usage cycles (cleanser = 45 days, serum = 60 days)

- “Your routine” emails showing what they bought + what’s missing from a complete regimen

- Early access to new launches for repeat customers

Then layered in AOV:

- “Complete your routine” bundles at checkout

- Free gift at ₹1,500 threshold

- Premium tool upsells

Result: Repeat rate jumped to 45%. AOV climbed from ₹999 to ₹1,340 for repeat customers.

Key insight: Frequency creates the foundation of repeat behavior. AOV targets repeat customers who are already confident to buy bundles or premium products.

The Smart Play: Sequence Matters

A common mistake is trying to “increase AOV and frequency” simultaneously with generic campaigns. The smarter move is sequencing based on payback:

1. If you’re not profitable on the first order → fix AOV/margin first

2. If you are profitable on the first order → scale frequency next

Common Mistakes (And How to Avoid Them)

Mistake 1: Trying to lift AOV and frequency simultaneously with generic “25% off” campaigns

Result: You train customers to wait for discounts, eroding both margin and natural repeat behavior. Your AOV looks good but your margins collapse. Your frequency increases but only when you’re discounting heavily.

Fix: Choose your lever based on the framework above, then protect margin with benefit-led offers (early access, bundles, loyalty points) instead of blanket percentage-off discounts.

Mistake 2: Measuring overall AOV/frequency instead of by cohort

Result: You can’t tell if your new strategy is actually working or if you’re just seeing seasonality, one-time spikes, or changes in traffic mix. December might look amazing, but is it your retention strategy or just festive shopping behavior?

Fix: Track monthly cohorts separately in your CRM. December 2024 customers should show improving repeat rates by February 2025. Compare December 2024 cohort to December 2023 cohort at the same lifecycle stage, that’s your real signal.

Mistake 3: Setting up automation once and never revisiting it

Result: Your “Day 7 winback” email stops working because customer behavior shifted, inbox algorithms changed, or offer fatigue set in but you don’t notice for months because you’re not actively monitoring performance.

Fix: Review automation performance monthly. If open rates drop or conversion rates fall, test new timing, messaging, or offer structure. Your CRM should let you A/B test these journeys automatically so you’re always optimizing.

Mistake 4: Focusing on frequency without margin protection

Result: You successfully increase orders per customer from 1.5 to 3.2 but you’ve decreased overall profitability because repeat customers now expect (and get) heavy discounts every time.

Fix: Structure loyalty and membership with non-discount benefits – free shipping, priority access, exclusive SKUs, early launch access, birthday rewards, community perks. Reserve discounts for true winback situations, not routine repeat purchases.

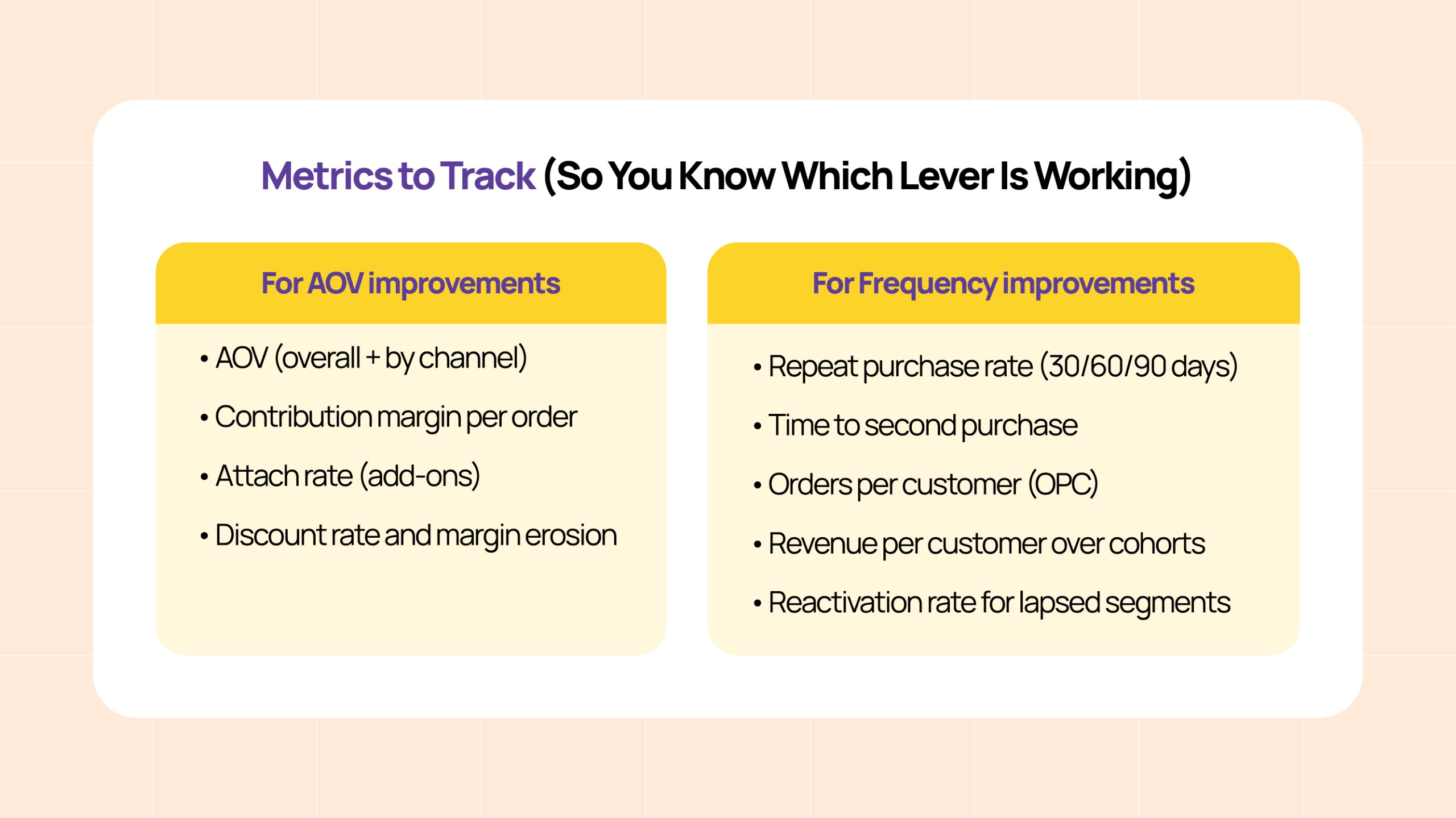

Metrics to Track (So You Know Which Lever Is Working)

1. For AOV improvements:

- AOV (overall + by channel) → Track by acquisition source to see if Instagram bundles convert differently than Google Search customers. This tells you where your AOV tactics are actually working.

- Contribution margin per order → Set alerts in your system when discount rate erodes margin below your target threshold (usually when discount % exceeds 15-18%).

- Attach rate (add-ons) → Test which product combinations have the highest natural attachment. A cleanser + moisturizer bundle might perform better than cleanser + serum.

- Discount rate and margin erosion → Are you lifting AOV through value (bundles, premiums) or through discounting? Only one is sustainable.

2. For Frequency improvements:

- Repeat purchase rate (30/60/90 days) → Segment by this metric in your CRM: High repeaters (30%+ at 90 days) get exclusive access perks, low repeaters (under 15%) get triggered winback campaigns.

- Time to second purchase → Use this to time your first replenishment reminder. If most second purchases happen around Day 45, trigger your reminder at Day 38-40.

- Orders per customer (OPC) → This is your true north metric for retention. Track this by cohort: Are newer cohorts ordering more frequently than older cohorts at the same lifecycle stage?

- Revenue per customer over cohorts → This tells you if frequency is actually compounding or if you’re just getting more orders at lower value. Both matter, but you want to see this metric climb over time.

- Reactivation rate for lapsed segments → What percentage of customers who went silent actually come back after your winback automation fires? If it’s under 8-10%, your messaging or offer needs work.

Pro tip: Always measure by cohorts, not overall averages. AOV can lift short-term numbers and make your dashboard look great, but frequency shows its real power in cohort curves. when you see February 2025 buyers outperforming February 2024 buyers at every lifecycle milestone.

Action Plan: What to Do This Week

If you choose AOV:

1. Create 2-3 bundles around your best-selling SKUs

- Look at products frequently bought together in past orders

- Price the bundle at 15-20% off individual item total

- Test these at checkout and on product pages

2. Add one threshold offer

- Free shipping at ₹X (set just above current AOV)

- Bonus loyalty points at ₹Y

- Free gift at ₹Z

- Configure this in your CRM so it triggers automatically when cart value approaches the threshold

3. Set up post-purchase cross-sell within 3 days

- WhatsApp/email: “Complete your [category] routine” or “Pairs perfectly with what you just bought”

- Most modern CRMs can trigger these based on what the customer actually purchased, not generic blasts

If you choose Frequency:

Set up 3 automated journeys in your CRM:

Journey 1: Post-purchase (Day 1-7)

- Day 1: Thank you + how to use/care tips

- Day 3: “How’s it working?” check-in

- Day 7: Cross-sell or “join our community” nudge

Journey 2: Replenishment/Next visit reminder

- Trigger based on product usage cycle or typical repurchase window

- For F&B/QSR: “We miss you” at Day 10-14

- For beauty/personal care: Product-specific reminders (cleanser = 45 days, serum = 60 days)

Journey 3: Winback (lapsed customer)

- Define “lapsed” for your category (30 days for QSR, 90 days for fashion, 75 days for beauty)

- First touch: Value reminder (not discount)

- Second touch: Benefit-led offer (early access, free shipping)

- Final touch: Discount (only if needed)

2. Segment “high-intent repeaters” in your CRM

- Use RFM scoring (Recency, Frequency, Monetary value) to identify your best repeat customers

- Give them exclusive perks: early launch access, priority support, special product drops, VIP events

3. Replace blanket discounts with benefit-led nudges

- Instead of “25% off everything”: “Free shipping on your next order” or “Early access to our new collection”

- Instead of generic sale announcements: “Based on what you loved last time, we think you’ll love this”

- Reserve heavy discounts for true winback situations, not regular repeat purchases

Conclusion: AOV vs Frequency – Which One Reduces CAC Faster (and When)?

AOV reduces CAC faster when you need immediate payback, your repeat cycle is long, or your checkout has strong upsell potential. It’s the right first move when you’re not yet profitable on first order or when your category isn’t naturally repeat-driven.

Frequency reduces CAC faster when your category is repeat-friendly and you can re-engage customers cheaply through CRM because repeat revenue compounds without re-paying acquisition costs. Once your first-order economics are healthy, this becomes your long-term growth engine.

The best brands don’t argue AOV vs frequency forever. They pick the lever that fixes payback first, then build the retention engine that compounds growth.

If your goal is sustainable CAC reduction at scale, frequency becomes the long-term winner but only if you operationalize it through proper CRM infrastructure: segmentation that identifies who to target, automation that executes without manual work, and a loyalty or membership strategy that protects margin while driving repeat behavior.

The framework is clear. The tactics are proven. Now it’s about execution and that’s where your CRM becomes the difference between a retention strategy you talk about and one that actually drives profit.